Follow The Money

flight data compiled from https://www.adsbexchange.com/

follow the money archives

Owner: 3M Company

Date: 10/23/2025

Origin: Van Nuys Airport (VNY / KVNY) – Los Angeles, California

Destination: St. Paul Downtown Airport (STP) – St. Paul, Minnesota (Corporate Headquarters)

Money Moves:

3M’s corporate jet completed the west-to-midwest flight from Los Angeles to St. Paul — a cross-country return from client-facing business to corporate command. The route suggests executive travel related to partnerships, litigation updates, or innovation initiatives, all of which have recently drawn 3M into high-stakes discussions with investors, manufacturers, and regulators on both coasts.

The most accurate interpretation: this trip likely carried senior legal, operational, or R&D leadership returning from California-based technology partners or legal counsel meetings tied to 3M’s ongoing post-spin realignment and environmental settlement follow-through. Van Nuys — a preferred gateway for discreet executive travel in Los Angeles — hints at private meetings rather than public-facing appearances.

The timing is also notable. Late October falls within 3M’s Q4 strategy window, when executives typically finalize year-end budgetary reviews, manufacturing efficiency goals, and innovation priorities heading into the next fiscal year.

From the palm-lined business enclaves of Los Angeles to the industrial heart of St. Paul, this flight symbolizes 3M’s enduring balance — a century-old innovator returning to its roots while navigating a new era of environmental accountability, product transformation, and leadership recalibration.

Owner: Eli Lilly and Company

Date: 10/22/2025

Origin: Teterboro Airport (TEB / KTEB) – Teterboro, New Jersey (New York Metro Region)

Destination: Indianapolis International Airport (IND / KIND) – Indianapolis, Indiana (Global Headquarters)

Money Moves:

Eli Lilly’s corporate jet departed the New York metro area and returned to its Indianapolis headquarters — a classic biopharma leadership route that likely followed high-level investor meetings, analyst sessions, or pharmaceutical partnership discussions in Manhattan. The timing — late October — places this flight squarely in the post–earnings disclosure window, when Lilly’s executives typically meet with institutional investors, equity analysts, and strategic advisors to refine messaging on growth outlook and drug pipeline momentum.

The most accurate interpretation: this trip likely carried CEO David Ricks, CFO Anat Ashkenazi, or senior corporate strategy officers returning from financial briefings or discussions with healthcare investment banks on Wall Street. With Eli Lilly’s leadership deeply focused on scaling its weight-loss and diabetes portfolio (notably Mounjaro and Zepbound), these meetings often precede or follow capital market updates, R&D pipeline showcases, and manufacturing expansion discussions.

The return to Indianapolis underscores the company’s strategic rhythm — finance first, operations next — as Lilly continues to navigate massive global demand for GLP-1 therapies, supply chain scaling, and upcoming FDA milestone decisions.

From New York’s financial epicenter to Indiana’s pharmaceutical heartland, this flight reflects Eli Lilly’s steady ascent — a once-regional drugmaker now shaping the global healthcare narrative from the lab bench to Wall Street’s boardrooms.

Owner: Altria Group, Inc.

Date: 10/22/2025

Origin: Harry Reid International Airport (LAS / KLAS) – Las Vegas, Nevada

Destination: Richmond International Airport (RIC) – Richmond, Virginia (Corporate Headquarters)

Money Moves:

Altria’s corporate jet made the long flight from Las Vegas back to Richmond — a cross-country return from the entertainment capital to the tobacco capital, likely signaling executive travel following investor meetings, industry conferences, or partnership discussions. Las Vegas frequently hosts major consumer goods, retail, and investment summits, and Altria’s leadership often uses such events to engage with institutional investors, distribution partners, or strategic brand collaborators.

The most accurate interpretation: this trip likely carried senior executives or investor relations personnel returning from consumer product showcases, tobacco and nicotine innovation briefings, or financial roadshows. The flight’s timing — late October — falls squarely in the post-earnings investor engagement window, when large-cap consumer companies like Altria typically meet with fund managers and analysts to discuss outlooks on pricing, regulation, and reduced-risk product development.

The direct return to Richmond underscores a pivot from market-facing discussions to internal strategic recalibration — particularly as Altria navigates regulatory headwinds, smoke-free product rollout, and evolving consumer demand across nicotine and non-nicotine categories.

From the neon glow of Las Vegas to the corporate calm of Richmond, this flight highlights Altria’s dual reality — a legacy company under constant reinvention, balancing Wall Street confidence with Main Street scrutiny.

Owner: Stryker Corporation

Date: 10/22/2025

Origin: Teterboro Airport (TEB / KTEB) – Teterboro, New Jersey (New York Metro Region)

Destination: Washington Dulles International Airport (IAD) – Washington, D.C.

Money Moves:

Stryker’s corporate jet departed Teterboro and flew to Washington Dulles — a Northeast-to-D.C. executive corridor that points to high-level government, policy, or healthcare regulatory meetings. As one of the world’s leading medical technology firms, Stryker maintains deep engagement with federal health agencies, reimbursement policymakers, and defense medical programs, all headquartered in or around the Washington metro area.

The most accurate interpretation: this trip likely carried senior government affairs, compliance, or strategy executives for meetings with the U.S. Department of Health and Human Services (HHS), the FDA, or federal procurement agencies. Stryker frequently interfaces with regulators on medical device approvals, pricing transparency, and innovation policy — and October marks a period when industry leaders meet policymakers ahead of the next fiscal year’s healthcare budget cycle.

The departure from Teterboro suggests the executives were coming directly from investor relations or capital market briefings in New York before heading to D.C. for policy coordination — a common back-to-back travel rhythm among healthcare multinationals balancing Wall Street expectations with Washington oversight.

From the financial pulse of New York to the policymaking corridors of the nation’s capital, this flight embodies Stryker’s position at the crossroads of innovation, regulation, and strategic growth.

Owner: The Home Depot, Inc.

Date: 10/22/2025

Origin: Fulton County Executive Airport – Brown Field (FTY) – Atlanta, Georgia (Corporate Headquarters Region)

Destination: Aeropuerto Internacional del Norte (ADN / MMAN) – Monterrey, Nuevo León, Mexico

Money Moves:

Home Depot’s corporate jet departed Atlanta’s Fulton County Brown Field — its private aviation base near corporate headquarters — and landed at Aeropuerto Internacional del Norte, Monterrey. This flight strongly suggests executive-level coordination related to Home Depot’s Latin American operations, supplier partnerships, or logistics network optimization. Monterrey serves as a key manufacturing and export hub, supplying major components, fixtures, and building materials to Home Depot’s U.S. and Mexico retail ecosystem.

The most accurate interpretation: this trip likely carried senior operations, international sourcing, or merchandising executives traveling for supply chain reviews, vendor negotiations, or expansion planning with Mexican manufacturing partners. Monterrey is central to Home Depot’s cross-border supply infrastructure, including partnerships for lumber, construction materials, and home improvement products shipped into the U.S.

The timing — late October — aligns with Q4 procurement planning and next-year sourcing agreements, when leadership finalizes vendor contracts and regional logistics forecasts ahead of peak spring-season inventory cycles.

From Atlanta’s executive corridors to Monterrey’s industrial skyline, this flight underscores Home Depot’s operational reach — a retail giant leveraging North American manufacturing strength and precise supply chain management to keep its orange empire running seamlessly.

Owner: Chick-fil-A, Inc.

Date: 10/22/2025

Origin: Cobb County International Airport (RYY) – Kennesaw, Georgia (Corporate Headquarters Region – Atlanta Metro)

Destination: Wiley Post Airport (PWA / KPWA) – Oklahoma City, Oklahoma

Money Moves:

Chick-fil-A’s corporate jet lifted from its suburban Atlanta base in Cobb County and touched down in Oklahoma City — a strategic route tied to real estate expansion, franchise development, or supply-chain coordination. Oklahoma has become one of Chick-fil-A’s fastest-growing regional markets, and Oklahoma City serves as a logistics and operations hub for its Midwest and Southwest distribution networks.

The most accurate interpretation: this trip likely carried development, operations, or supply chain leadership for site evaluations, franchise partner meetings, or supplier contract reviews. Oklahoma’s strong demographic growth and central location make it an ideal staging point for Chick-fil-A’s regional expansion strategy and distribution optimization.

Mid-October also aligns with corporate planning for 2026 openings and capital deployment, suggesting this flight may have supported multi-state rollout coordination or internal market assessments.

From Atlanta’s headquarters to Oklahoma’s heartland, this flight captures Chick-fil-A’s disciplined expansion model — privately held, family-led, and laser-focused on operational excellence as it scales across America’s fastest-growing markets.

Owner: Pfizer Inc.

Date: 10/22/2025

Origin: Teterboro Airport (TEB / KTEB) – Teterboro, New Jersey (Corporate Headquarters Region – Manhattan/Hudson Yards HQ)

Destination: Montréal–Trudeau International Airport (YUL / CYUL) – Montréal, Québec, Canada

Money Moves:

Pfizer’s corporate jet departed its New York metro headquarters base at Teterboro and flew north to Montréal — a cross-border executive route that signals leadership travel tied to biopharma partnerships, vaccine manufacturing, or regulatory coordination with Canadian health authorities and partners.

The most accurate interpretation: this trip likely carried Pfizer’s international operations, manufacturing, or government affairs executives traveling for meetings with Health Canada, Canadian distribution partners, or biotechnology collaborators. Pfizer maintains strong research and commercial ties in Canada, particularly in Montréal, where the city’s biotech cluster supports drug development, vaccine logistics, and cold-chain infrastructure — all central to Pfizer’s expanding biologics and mRNA portfolio.

The mid-October timing suggests Q4 strategic alignment for 2026 production and regulatory planning, coinciding with seasonal vaccine demand and next-generation therapy rollouts. The use of Teterboro, rather than JFK, underscores C-suite confidentiality and speed, enabling quick turnarounds between Pfizer’s Manhattan HQ and international partners.

From the corporate towers of New York to the biomedical corridors of Montréal, this flight reflects Pfizer’s global tempo — a pharmaceutical titan linking science, regulation, and logistics across borders with surgical precision.

Owner: Wynn Resorts, Limited

Date: 10/22/2025

Origin: LaGuardia Airport (LGA / KLGA) – New York, New York

Destination: Ronald Reagan Washington National Airport (DCA) – Washington, D.C.

Money Moves:

Wynn Resorts’ corporate jet made the short but highly strategic trip from New York to Washington, D.C. — a boardroom-to-policy flight that strongly suggests executive-level engagement with regulators, policymakers, or federal partners. Wynn’s East Coast travel patterns often align with legislative, lobbying, or financial meetings tied to gaming regulation, hospitality development, or capital markets activity.

The most accurate interpretation: this trip likely carried Wynn’s senior leadership or government affairs executives traveling to Washington for meetings with lawmakers, tourism boards, or gaming regulators regarding ongoing expansion initiatives, tax structure negotiations, or responsible gaming legislation. With Wynn continuing to expand its U.S. and global footprint — including integrated resort projects and digital gaming ventures — D.C. remains a crucial arena for maintaining regulatory alignment and political visibility.

The departure from LaGuardia suggests prior media or investor meetings in New York, potentially tied to earnings previews, bond market discussions, or institutional partner engagement. The back-to-back East Coast route — New York to D.C. — mirrors Wynn’s executive cadence: finance, then policy.

From Manhattan’s financial towers to Capitol Hill’s marble halls, this flight reflects Wynn Resorts’ evolution — a global hospitality powerhouse navigating the intersection of luxury, regulation, and influence one flight at a time.

Owner: Abbott Laboratories

Date: 10/22/2025

Origin: Boeing Field / King County International Airport (BFI) – Seattle, Washington

Destination: Waukegan National Airport (UGN / KUGN) – Waukegan, Illinois (Corporate Headquarters Region – Abbott Park)

Money Moves:

Abbott’s corporate jet flew from Seattle’s Boeing Field to Waukegan, marking a coast-to-Midwest executive route likely tied to medical technology, diagnostics, or supply-chain operations. Boeing Field serves as a preferred private aviation hub for corporate traffic in Seattle, where Abbott maintains strategic partnerships in biotechnology, device manufacturing, and digital health innovation.

The most accurate interpretation: this trip likely carried senior executives or technical leadership returning from partnership meetings or R&D reviews with West Coast technology firms, biotech collaborators, or healthcare providers. Seattle’s innovation ecosystem — home to leaders in AI, cloud computing, and life sciences — aligns closely with Abbott’s push into connected diagnostics, wearable health devices, and data-driven patient monitoring.

The flight’s arrival into Waukegan, just minutes from Abbott’s global headquarters in Abbott Park, underscores direct executive reintegration for internal strategy sessions or Q4 operational briefings.

From the Pacific Northwest’s innovation belt to the industrial precision of Northern Illinois, this flight captures Abbott’s global rhythm — bridging frontier health tech with the disciplined execution of one of the world’s most enduring medical device and diagnostics leaders.

Owner: Marc Benioff (Salesforce)

Date: 10/21/2025

Origin: Ellison Onizuka Kona International Airport (KOA) – Kailua-Kona, Hawaii

Destination: Orlando International Airport (MCO / KMCO) – Orlando, Florida

Money Moves:

Benioff’s jet lifted from Kona for Orlando—a long-range repositioning that tracks with enterprise client work, partner summits, or keynote-level appearances. Given Kona’s proximity to Lānaʻi, a private stopover with Larry Ellison (Oracle founder, Marc’s old boss) for cloud, data, or philanthropy dialogue is a credible—but unverified—prelude to the mainland leg. Orlando’s convention grid and enterprise corridor make it a natural next stop for Q4 pipeline reviews, customer councils, and ecosystem briefings.

Owner: Centene Corporation

Date: 10/21/2025

Origin: Clark Regional Airport (JVY) – Jeffersonville, Indiana (Louisville Metro Area)

Destination: St. Louis Lambert International Airport (STL / KSTL) – St. Louis, Missouri (Corporate Headquarters)

Money Moves:

Centene’s corporate jet departed the Louisville area and returned to St. Louis — a strategic regional route that reflects the company’s intense focus on Medicaid operations, provider partnerships, and government relations across the Midwest and South. The Louisville region has become a key market for healthcare policy activity and managed-care competition, making this flight likely tied to regional Medicaid contract management, provider negotiations, or state-level health policy meetings.

The most accurate interpretation: this trip likely carried executives from Centene’s regional operations or government affairs teams returning from state Medicaid or provider network meetings with Kentucky officials and healthcare partners. Kentucky’s Medicaid program — one of the most competitive in the region — directly overlaps with Centene’s WellCare and Ambetter subsidiaries, both of which play major roles in state-managed healthcare delivery.

The timing — mid-October — is critical for the healthcare sector, aligning with open enrollment preparation, Medicaid renewal cycles, and state contract renewals that define Centene’s revenue visibility for the coming fiscal year.

From the policy rooms of Kentucky to the headquarters corridors of St. Louis, this flight captures Centene’s operational rhythm — a data-driven healthcare powerhouse balancing policy navigation, local partnerships, and national execution.

Owner: International Business Machines Corporation (IBM)

Date: 10/21/2025

Origin: Westchester County Airport (HPN) – White Plains, New York (Corporate Headquarters Region, Armonk)

Destination: Kissimmee Gateway Airport (ISM) – Kissimmee, Florida (Greater Orlando Area)

Money Moves:

IBM’s corporate jet departed its headquarters region in Westchester County and flew south to Kissimmee — a strategically telling route that points to executive or client travel tied to technology infrastructure, cloud partnerships, or government and enterprise contracts in Central Florida. Kissimmee Gateway Airport sits minutes from Orlando’s growing tech corridor, where IBM maintains relationships with major partners in aerospace, defense, and data analytics integration.

The most accurate interpretation: this flight likely carried senior IBM Cloud, Consulting, or AI division leaders traveling for meetings with key enterprise clients, local government tech partners, or data center stakeholders. Central Florida has become a hub for defense contracting, simulation technology, and public-private cloud computing initiatives, areas that align directly with IBM’s AI, hybrid cloud, and quantum computing strategies.

The timing — mid-October — coincides with IBM’s Q4 strategic planning and partnership cycle, when executives typically review enterprise contract performance, regional partnerships, and technology deployment roadmaps across U.S. innovation hubs.

From the wooded campuses of Armonk to the fast-growing innovation zones of Central Florida, this flight embodies IBM’s next-era focus — a century-old tech titan reinventing itself at the intersection of AI, cloud, and government innovation.

Owner: Hilton Worldwide Holdings Inc.

Date: 10/21/2025

Origin: Burke Lakefront Airport (BKL) – Cleveland, Ohio

Destination: Orlando Executive Airport (ORL / KORL) – Orlando, Florida (Corporate Operations Hub & Regional Headquarters)

Money Moves:

Hilton’s corporate jet traveled from Cleveland’s Burke Lakefront to Orlando Executive — a business-oriented route that likely reflects executive coordination tied to hospitality development, franchise operations, or brand strategy. While Hilton’s global headquarters is in McLean, Virginia, the company manages a significant portion of its Southeast regional and resort operations from its Orlando offices, a strategic base for its Waldorf Astoria, Conrad, and Hilton Grand Vacations portfolios.

The most accurate interpretation: this trip likely carried Hilton development or operations executives following property management reviews, ownership group meetings, or hospitality investment discussions in the Midwest. Cleveland is a growing regional hub for Hilton-managed properties and ownership groups, and mid-October aligns with Q4 revenue management and 2026 brand rollout planning — prime timing for franchisee and developer engagement.

Orlando Executive Airport’s proximity to Hilton’s major resort operations and conference centers allows for rapid reentry into regional command, reflecting the company’s precision in overseeing its luxury and resort pipeline.

From the Great Lakes to Florida’s hospitality core, this flight represents Hilton’s operational DNA — a global hospitality leader balancing brand growth, partner relations, and guest experience excellence across every corner of the map.

Owner: UnitedHealth Group Incorporated (UHG)

Date: 10/21/2025

Origin: Minneapolis–Saint Paul International Airport (MSP / KMSP) – Minneapolis, Minnesota (Corporate Headquarters)

Destination: Teterboro Airport (TEB / KTEB) – Teterboro, New Jersey (New York Metro Region)

Money Moves:

UnitedHealth Group’s corporate jet lifted off from Minneapolis–Saint Paul and landed at Teterboro — a strategic executive route linking the Midwest’s healthcare capital with the financial and policy centers of the East Coast. Teterboro, the private aviation hub for New York City, provides fast, discreet access to institutional investors, policy organizations, and healthcare partners concentrated in Manhattan and Washington corridors.

The most accurate interpretation: this trip likely carried senior executives from Optum or UnitedHealthcare divisions for investor briefings, M&A discussions, or healthcare policy meetings with East Coast financial firms and regulators. With UnitedHealth positioned at the nexus of insurance, data analytics, and care delivery, mid-October marks a key period for earnings updates, healthcare cost forecasting, and strategic partner alignment going into year-end.

The direct use of Teterboro, rather than a commercial hub, signals C-suite level confidentiality and operational precision, a hallmark of UnitedHealth’s corporate culture.

From the medical command towers of Minnesota to the skyscrapers of Manhattan, this flight reflects UnitedHealth’s stature as America’s healthcare giant — quietly connecting policy, finance, and innovation one executive flight at a time.

Owner: Air Products and Chemicals, Inc.

Date: 10/21/2025

Origin: San Francisco International Airport (SFO / KSFO) – San Francisco, California

Destination: Sacramento Executive Airport (SAC / KSAC) – Sacramento, California

Money Moves:

Air Products’ corporate jet made the short but telling hop from San Francisco to Sacramento — a route that likely reflects executive-level policy, energy, or infrastructure coordination within California. Air Products, one of the world’s largest hydrogen and industrial gas producers, has been expanding aggressively in clean energy, hydrogen refueling, and carbon-capture projects throughout the state.

The most accurate interpretation: this trip likely carried government affairs, energy transition, or project development executives traveling for meetings with state officials, environmental regulators, or partners tied to California’s decarbonization and hydrogen infrastructure programs. Sacramento, home to key energy agencies like the California Energy Commission and Air Resources Board (CARB), is the epicenter of state-level clean-fuel policy — making this an essential stop for Air Products’ leadership as federal and state hydrogen incentives ramp up.

The short-haul flight from San Francisco — where Air Products regularly engages with tech, logistics, and renewable fuel partners — to Sacramento underscores the company’s integrated West Coast strategy: bridging private-sector innovation with public-sector energy policy.

From the tech capital of the Bay Area to the policy corridors of California’s capital, this flight captures Air Products’ mission in motion — executives advancing hydrogen, sustainability, and industrial innovation to power the state’s clean energy future.

Owner: Berry Global Group, Inc.

Date: 10/21/2025

Origin: Evansville Regional Airport (EVV) – Evansville, Indiana (Corporate Headquarters)

Destination: Chicago Executive Airport (PWK / KPWK) – Wheeling, Illinois

Money Moves:

Berry Global’s corporate jet took off from Evansville and landed at Chicago Executive Airport — a short yet strategic route that likely reflects executive travel related to investor relations, client meetings, or M&A discussions in the Chicago metro area. Berry Global, a global leader in plastic packaging, engineered materials, and sustainability-driven design, frequently engages with its financial partners, institutional investors, and major CPG customers headquartered in or near Chicago.

The most accurate interpretation: this trip likely carried C-suite leadership or financial officers traveling for corporate finance meetings, partnership reviews, or sustainability program briefings with top consumer brands and private equity firms. Chicago serves as a central hub for several of Berry’s largest packaging clients — including household and personal care giants — making it a key market for strategic account management and contract renewals.

The mid-October timing aligns with Berry Global’s Q4 business cycle, when leadership finalizes capital expenditures, sustainability reporting, and next-year contract pricing structures.

From Evansville’s manufacturing command center to Chicago’s financial corridors, this flight represents Berry Global’s dual identity — industrial precision backed by global-scale customer and capital relationships.

Owner: CBS Mass Media Corporation (Paramount Global)

Date: 10/21/2025

Origin: Teterboro Airport (TEB / KTEB) – Teterboro, New Jersey (New York Metro / Corporate Headquarters Region)

Destination: Van Nuys Airport (VNY / KVNY) – Los Angeles, California

Money Moves:

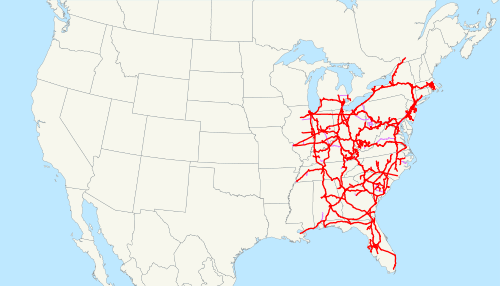

CBS’s corporate jet departed its New York–area base at Teterboro and headed for Van Nuys — the classic media industry route linking the East Coast broadcast command center with the entertainment capital of the world. This flight almost certainly represents executive-level coordination across production, advertising, and network programming divisions, as CBS continues to synchronize its news, streaming, and television assets under the Paramount Global umbrella.

The most accurate interpretation: this trip likely carried senior network executives, content strategists, or financial officers traveling to Los Angeles for programming reviews, affiliate negotiations, or partnership meetings with major studios, talent agencies, and advertisers. With fall television seasons in full swing and 2026 production calendars being finalized, the timing fits CBS’s quarterly creative and business alignment sessions.

The direct arrival into Van Nuys — preferred by top entertainment executives for its privacy, proximity to Studio City, and 24/7 private terminal access — highlights the blend of speed and discretion typical of major media movements.

From the skyscrapers of Manhattan to the soundstages of Los Angeles, this flight captures CBS’s enduring dynamic — a coast-to-coast media giant balancing Wall Street precision with Hollywood storytelling power.

Owner: United States Steel Corporation (U.S. Steel)

Date: 10/18/2025

Origin: Los Angeles International Airport (LAX / KLAX) – Los Angeles, California

Destination: Pittsburgh International Airport (PIT / KPIT) – Pittsburgh, Pennsylvania (Corporate Headquarters)

Money Moves:

U.S. Steel’s corporate jet made the long cross-country flight from Los Angeles to Pittsburgh — a route that likely reflects executive-level coordination between West Coast industrial operations and the company’s leadership team at headquarters. Los Angeles has become increasingly relevant for U.S. Steel due to its commercial relationships with fabrication, energy infrastructure, and materials technology firms, as well as the port’s logistical role in global steel distribution.

The most accurate interpretation: this trip likely carried senior operations or strategic planning executives returning from partnership or supplier meetings focused on innovation, clean manufacturing, or advanced materials integration. U.S. Steel continues to evolve beyond legacy blast furnaces toward electric arc and low-carbon production, and California’s industrial ecosystem is central to both regulatory collaboration and clean-tech partnerships.

The mid-October timing aligns with Q4 capital planning and modernization reviews, a period when executive teams often conduct on-site evaluations of supply-chain performance, sustainability projects, and customer commitments.

From Los Angeles’s industrial corridors to Pittsburgh’s steel-built skyline, this flight represents U.S. Steel’s modern identity — a 120-year-old American icon balancing its heritage of heavy industry with a forward-looking vision of sustainable, technology-driven steelmaking.

Owner: Starbucks Corporation

Date: 10/18/2025

Origin: Long Beach Airport (LGB) – Long Beach, California

Destination: South Bend International Airport (SBN) – South Bend, Indiana

Money Moves:

Starbucks’ corporate jet departed Long Beach and landed at South Bend — a strategic coast-to-heartland route that points to executive travel tied to U.S. supply chain, manufacturing, or store network oversight. While Starbucks’ corporate headquarters is in Seattle, the company’s operational leadership frequently travels across the country to manage production facilities, distribution networks, and regional partnerships critical to its massive retail footprint.

The most accurate interpretation: this flight likely carried supply chain, manufacturing, or corporate development executives traveling from California — a hub for Starbucks’ roasting, beverage innovation, and sustainability initiatives — to Indiana, home to key Midwestern roasting and logistics partners. South Bend’s proximity to the company’s Kent, Ohio, and York, Pennsylvania roasting plants, along with Midwest distribution centers, makes it an ideal gateway for operational site visits and partner coordination.

The timing — mid-October — suggests preparation for holiday-season logistics and Q4 production scaling, one of Starbucks’ most demanding operational periods. The direct private routing indicates high-level, time-sensitive oversight of U.S. supply systems ahead of the seasonal retail surge.

From California’s coastal innovation hubs to Indiana’s industrial core, this flight captures Starbucks’ operational heartbeat — a global brand grounded in craftsmanship, logistics precision, and executive execution that keeps coffee flowing from bean to cup worldwide.

Owner: Trump Family (Donald J. Trump & Family Office)

Date: 10/18/2025

Origin: Palm Beach International Airport (PBI) – West Palm Beach, Florida (Trump’s Primary Residence and Mar-a-Lago Base of Operations)

Destination: Los Angeles International Airport (LAX / KLAX) – Los Angeles, California

Money Moves:

The Trump family jet departed Palm Beach and touched down at Los Angeles International — a cross-country power route that blends business, politics, and entertainment in classic Trump fashion. West Palm Beach serves as the nerve center of the Trump Organization’s personal and political activity, while Los Angeles remains a key arena for media production, campaign fundraising, and private real-estate interests.

The most accurate interpretation: this flight likely carried members of the Trump family or senior aides traveling for media appearances, donor meetings, or real-estate portfolio oversight on the West Coast. The family maintains long-standing ties to the Los Angeles area through celebrity, hospitality, and entertainment connections, and mid-October represents a peak window for fundraising dinners, campaign positioning, and media strategy coordination heading into the 2026 election cycle.

Flying into LAX’s private terminals — rather than a smaller executive airport — suggests high-profile coordination requiring access to major broadcast studios or legal offices in downtown and Beverly Hills. The Trump aircraft, typically a Boeing 757 or Cessna Citation X depending on mission, is emblematic of the family’s blend of luxury branding and logistical precision.

From the palm-lined runways of South Florida to the glimmering skyline of Los Angeles, this flight encapsulates the Trump family’s global footprint — where politics, media, and empire building converge at 41,000 feet.

Owner: Graeme Hart (Rank Group Founder, Private Investor, Packaging Magnate)

Date: 10/18/2025

Origin: Madrid–Barajas Adolfo Suárez Airport (MAD) – Madrid, Spain

Destination: London Luton Airport (LTN) – London, United Kingdom

Money Moves:

Graeme Hart’s private jet departed Madrid and landed at London Luton — a refined, business-driven route that points to strategic investment travel across Europe’s financial capitals. As one of the world’s most private billionaires and the controlling force behind Rank Group and Reynolds Packaging, Hart often moves between industrial assets in continental Europe and financial or advisory centers in London.

The most accurate interpretation: this trip likely carried Hart or senior Rank Group advisors following portfolio management meetings, debt refinancing discussions, or acquisition reviews tied to the packaging, logistics, or materials sectors. Spain remains a hub for Hart’s manufacturing and distribution holdings, while London serves as the epicenter of European private capital, leveraged finance, and deal structuring—particularly relevant to Hart’s style of highly leveraged industrial ownership.

The mid-October timing coincides with Q4 capital allocation and restructuring cycles, when private equity groups and family offices position portfolios for year-end reporting and 2026 market conditions. The choice of Luton Airport—a preferred hub for ultra-high-net-worth and institutional jet traffic—reflects the confidentiality and efficiency typical of Hart’s operations.

From Madrid’s industrial corridors to London’s financial skyline, this flight exemplifies Graeme Hart’s global rhythm — a billionaire operator quietly steering multibillion-dollar packaging, finance, and infrastructure interests across continents with disciplined precision.

Owner: Walmart Inc.

Date: 10/18/2025

Origin: Wichita Dwight D. Eisenhower National Airport (ICT) – Wichita, Kansas

Destination: Rogers Executive Airport (ROG) – Rogers, Arkansas (Walmart Global Headquarters region)

Money Moves:

Walmart’s corporate jet departed Wichita and arrived at Rogers Executive Airport—the private aviation hub for its Bentonville corporate campus. This routing strongly indicates a high-level leadership movement, not routine logistics. Wichita sits in the heart of the “Air Capital” region, with close ties to manufacturing, aerospace & industrial engineering—sectors that are increasingly relevant to Walmart’s supply-chain and logistics modernization efforts.

The most accurate interpretation: this flight likely transported senior Walmart executives—perhaps from supply chain, procurement, or operations—returning from meetings or site visits in Kansas (potentially involving vendors or manufacturing partnerships) back to corporate headquarters to direct next-phase strategy and alignment. The choice of Rogers Executive Airport—just minutes from Walmart’s Home Office—ensures rapid reintegration into headquarters operations and decision-making.

From the manufacturing hubs of Kansas to the command center of one of retail’s largest empires in Arkansas, this flight captures Walmart’s operational architecture—executive mobility that ensures supplier engagement and corporate oversight remain seamlessly synchronized.

Owner: Bank of America Corporation

Date: 10/18/2025

Origin: Augusta Regional Airport (AGS) – Augusta, Georgia

Destination: LaGuardia Airport (LGA / KLGA) – New York, New York (Corporate Headquarters Region)

Money Moves:

Bank of America’s corporate jet departed Augusta and landed at LaGuardia — a southeastern-to-northeastern route that almost certainly represents executive-level travel tied to private wealth management, corporate client relations, or strategic meetings with financial partners. Augusta is home to a cluster of ultra–high-net-worth clients and private banking relationships, making it a common launch point for Bank of America’s Private Bank and Merrill Wealth Management divisions.

The most accurate interpretation: this flight likely carried senior wealth management or regional banking executives traveling to New York for earnings-related coordination, strategic planning, or investor engagement sessions at the bank’s main offices in Manhattan. Given the mid-October date, this trip coincides with quarterly reporting season—a period when top executives typically consolidate performance data and finalize capital market outlooks with institutional investors.

LaGuardia’s private terminals provide fast, discreet access to Bank of America Tower at Bryant Park and its financial leadership offices, underscoring the importance of time-sensitive travel during reporting and strategy weeks.

From the manicured fairways of Augusta to the skyline of Manhattan, this flight encapsulates Bank of America’s dual identity — Main Street relationships fueling Wall Street’s financial machinery, all synchronized through precision executive mobility.

Owner: JPMorgan Chase & Co.

Date: 10/18/2025

Origin: Boeing Field / King County International Airport (BFI) – Seattle, Washington

Destination: Westchester County Airport (HPN) – White Plains, New York (Corporate Aviation Hub for NYC Headquarters)

Money Moves:

JPMorgan Chase’s corporate jet departed Boeing Field and landed at Westchester County Airport — a cross-country executive route that reflects top-level coordination between the bank’s West Coast client base and its New York headquarters. Boeing Field, located minutes from downtown Seattle, frequently handles private departures for major tech, aerospace, and venture clients, many of whom are key banking partners of JPMorgan’s commercial and investment divisions.

The most accurate interpretation: this flight likely carried senior investment bankers, corporate relationship managers, or West Coast executive leadership returning from high-value client meetings with technology, manufacturing, or venture-backed firms. JPMorgan Chase maintains deep ties across the Pacific Northwest, managing relationships with major names in cloud infrastructure, defense, and capital markets financing.

The timing — mid-October — coincides with Q4 corporate banking reviews, deal pipeline updates, and private-wealth planning sessions that typically require in-person coordination between the firm’s regional offices and senior leadership in New York. The arrival at Westchester ensures direct, private access to Manhattan’s financial center while avoiding the congestion of JFK or Newark.

From Seattle’s innovation corridor to New York’s banking command center, this flight captures JPMorgan’s operational scale — a financial powerhouse connecting America’s tech economy with Wall Street capital through nonstop executive precision.

Owner: Eli Lilly and Company

Date: 10/18/2025

Origin: Berlin Brandenburg Airport (BER / Flughafen Berlin Brandenburg) – Berlin, Germany

Destination: Indianapolis International Airport (IND / KIND) – Indianapolis, Indiana (Corporate Headquarters)

Money Moves:

Eli Lilly’s corporate jet made the transatlantic journey from Berlin to Indianapolis — a high-level route that underscores executive coordination between the company’s European operations and its global headquarters in the U.S. Berlin serves as a central hub for Lilly’s European R&D, regulatory, and biopharmaceutical policy engagements, particularly as the company deepens its presence in metabolic, oncology, and immunology markets across the EU.

The most accurate interpretation: this flight likely carried senior international executives, regulatory strategists, or R&D leadership returning from meetings with European Union health authorities, biotech partners, or clinical research institutions. Germany remains a key region for Lilly’s insulin and diabetes-care initiatives, with several collaborations and manufacturing partnerships supporting its expanding biologics pipeline.

The mid-October date aligns with Lilly’s global business rhythm — a period marked by Q4 strategic reviews, global drug launch planning, and cross-market coordination between U.S. leadership and European affiliates. The direct flight into Indianapolis signals a swift transition from global field operations to headquarters-level decision-making ahead of earnings and product pipeline updates.

From Berlin’s biotech corridors to the pharmaceutical heart of Indiana, this flight encapsulates Eli Lilly’s global command cycle — science-driven leadership linking continents through precision, innovation, and strategic execution at 40,000 feet.

Owner: Wesley R. Edens (Founder, Fortress Investment Group; Co-owner, Milwaukee Bucks & Brightline Trains)

Date: 10/18/2025

Origin: Harry Reid International Airport (KLAS) – Las Vegas, Nevada

Destination: Van Nuys Airport (VNY) – Los Angeles, California

Money Moves:

Wesley Edens’ private jet departed Las Vegas and landed at Van Nuys — a short, high-profile West Coast route that aligns with executive travel tied to investment meetings, sports ventures, or entertainment-industry partnerships. Van Nuys, located in the San Fernando Valley, is one of the busiest private jet airports in the U.S. and the preferred gateway for Los Angeles business leaders and financiers seeking quick access to Beverly Hills, Malibu, and Century City.

The most accurate interpretation: this trip likely carried Edens or Fortress Investment Group executives returning from Las Vegas-based business or investor conferences, real estate discussions, or Brightline West rail project oversight. The Brightline West high-speed rail line — backed by Edens — is currently in development between Las Vegas and Southern California, making this flight directly relevant to project management or political stakeholder engagement along the corridor.

The timing, mid-October, also coincides with Las Vegas investor gatherings and infrastructure summits, suggesting Edens’ travel could have tied to funding reviews, transportation briefings, or hospitality investment talks linked to his broader portfolio.

From the desert skyline of Las Vegas to the palm-lined private terminals of Van Nuys, this flight captures Wesley Edens’ operational rhythm — a billionaire investor bridging infrastructure, finance, and lifestyle sectors from air to rail, coast to coast.

Owner: ExxonMobil Corporation (XOM)

Date: 10/18/2025

Origin: Austin–Bergstrom International Airport (AUS) – Austin, Texas

Destination: George Bush Intercontinental Airport (IAH) – Houston, Texas (Corporate Headquarters)

Money Moves:

ExxonMobil’s corporate jet made the short but strategically meaningful flight from Austin to Houston — a route that reflects executive-level coordination between the company’s policy, technology, and energy transition divisions. Austin has become a frequent destination for ExxonMobil’s senior leadership due to its growing presence in government affairs, university partnerships, and innovation collaborations tied to the energy transition and carbon capture initiatives.

The most accurate interpretation: this trip likely carried corporate affairs, R&D, or strategic development executives returning from meetings with Texas state officials, University of Texas energy researchers, or venture partners in carbon management, hydrogen, or advanced materials. ExxonMobil has steadily expanded its influence in Austin’s policy and innovation circles, using the city as a secondary base for legislative engagement and sustainable technology scouting.

The direct flight into Bush Intercontinental — home to ExxonMobil’s headquarters and executive aviation hub — suggests a swift return for leadership debriefings and strategic updates within the company’s senior management team.

From Austin’s tech corridors to Houston’s energy epicenter, this flight embodies ExxonMobil’s modern strategy — bridging policy and innovation to secure its leadership position in the evolving global energy landscape.

Owner: The Boeing Company

Date: 10/17/2025

Origin: Austin Executive Airport (EDC) – Austin, Texas

Destination: Gary/Chicago International Airport (GYY) – Gary, Indiana (Greater Chicago Area)

Money Moves:

Boeing’s corporate jet departed Austin Executive Airport and flew north to Gary/Chicago International — a route that underscores high-level executive travel between Boeing’s engineering, defense, and supply-chain operations in Texas and its leadership or production network in the Chicago region.

The most accurate interpretation: this flight likely carried senior engineering, program management, or corporate strategy executives traveling from Boeing’s growing presence in Texas — where the company has expanded defense systems, avionics, and software engineering teams — to meet with counterparts in the Chicago and Midwest area, long home to Boeing’s commercial and corporate infrastructure prior to its headquarters relocation to Arlington, Virginia.

The timing — mid-October — fits Boeing’s internal review and production coordination calendar, when leadership typically finalizes supply-chain readiness, defense contract updates, and commercial aircraft delivery forecasts heading into Q4. Gary’s airport offers Boeing the privacy and logistical ease of private access to both Chicago-area business centers and Midwestern manufacturing suppliers without the congestion of O’Hare.

From Austin’s innovation corridors to the industrial lakeshore of Indiana, this flight reflects Boeing’s operational rhythm — engineering talent in the South linking seamlessly with the company’s manufacturing and corporate power base in the Midwest.

Owner: Woodward, Inc.

Date: 10/17/2025

Origin: Chicago Executive Airport (PWK) – Wheeling, Illinois

Destination: Northern Colorado Regional Airport (FNL) – Loveland, Colorado (Corporate Headquarters Region – Fort Collins)

Money Moves:

Woodward’s corporate jet departed Chicago Executive Airport and returned to Northern Colorado Regional — a route that signifies executive-level coordination between the company’s aerospace and industrial divisions. Woodward maintains major operational and customer-facing offices in the Midwest while its corporate headquarters and core engineering centers sit along Colorado’s Front Range.

The most accurate interpretation: this trip likely carried senior engineering, sales, or program management executives following client visits with aerospace manufacturers or defense partners in the Chicago area. The region houses several of Woodward’s key customers and suppliers in the aviation, turbine, and energy systems markets, making it a frequent stop for product integration reviews and technical briefings.

The direct return to Loveland suggests immediate re-engagement with design, testing, or production teams at headquarters — an efficient close to a trip centered on performance updates and contract coordination.

From the factory floors of the Midwest to the innovation corridors of Northern Colorado, this flight exemplifies Woodward’s DNA — precision engineering, customer partnership, and agile leadership bridging America’s aerospace supply chain.

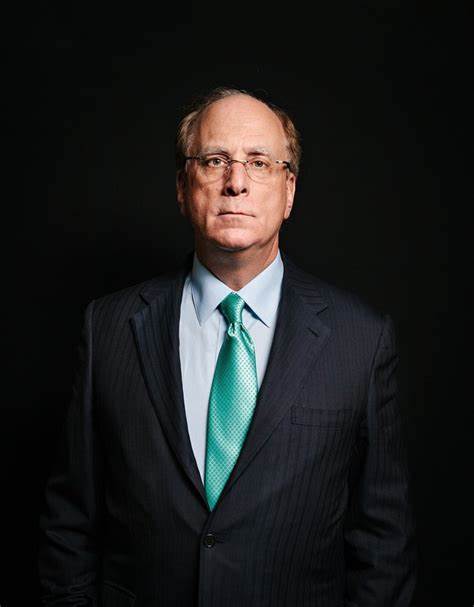

Owner: BlackRock, Inc.

Date: 10/17/2025

Origin: Paris–Le Bourget Airport (LBG) – Paris, France

Destination: Westchester County Airport (HPN) – White Plains, New York (Corporate Aviation Hub for BlackRock Headquarters in Manhattan)

Money Moves:

BlackRock’s corporate jet departed Paris–Le Bourget and landed at Westchester County Airport — a transatlantic route emblematic of top-tier financial coordination between BlackRock’s European and U.S. leadership teams. Le Bourget, the preferred private aviation hub for Europe’s financial elite, often hosts departures following policy meetings, investor summits, or central bank discussions.

The most accurate interpretation: this trip likely carried BlackRock’s senior global executives or EMEA leadership returning from high-level engagements with European regulators, sovereign wealth clients, or institutional investors. The firm’s Paris office anchors much of its European ESG, ETF, and policy strategy, and October’s timing suggests the flight followed portfolio allocation reviews and year-end macroeconomic briefings amid shifting central bank policy and market volatility.

Arriving at Westchester rather than a commercial hub like JFK underscores confidentiality and proximity to BlackRock’s Manhattan headquarters, allowing executives to re-enter the U.S. with minimal delay for immediate debriefs and global coordination calls.

From the marble halls of Paris to the boardrooms of New York, this flight reflects BlackRock’s true global rhythm — capital, policy, and strategy moving in perfect sync across continents as the world’s largest asset manager shapes financial markets from both sides of the Atlantic.

Owner: Oaktree Capital Management, L.P.

Date: 10/17/2025

Origin: Westchester County Airport (HPN) – White Plains, New York (New York Metro Region)

Destination: New Castle County Airport (ILG) – Wilmington, Delaware

Money Moves:

Oaktree Capital’s corporate jet made the short hop from Westchester to Wilmington — a brief but meaningful route that signals executive travel tied to fund administration, regulatory, or legal structuring activity. Wilmington, Delaware remains the epicenter of U.S. corporate and private equity law, housing the registration and governance frameworks for many of Oaktree’s funds and subsidiaries.

The most accurate interpretation: this trip likely carried senior fund counsel, managing directors, or operations executives for meetings with legal advisors, trust administrators, or corporate governance partners managing Oaktree’s Delaware entities. Such flights are common ahead of fund closings, corporate filings, or partnership restructurings, particularly in Q4 when investment vehicles are finalized before year-end.

The use of Westchester Airport underscores Oaktree’s preference for discreet, time-efficient executive travel out of the New York area, allowing senior leadership to move between Wall Street and Delaware’s corporate offices without public visibility.

From New York’s financial stronghold to Delaware’s legal backbone, this flight exemplifies how Oaktree operates — quiet precision, legal sophistication, and disciplined capital management underpinning one of the world’s most respected alternative investment firms.

Owner: Dell Technologies Inc.

Date: 10/17/2025

Origin: San Jose Mineta International Airport (SJC) – San Jose, California (Silicon Valley)

Destination: Austin–Bergstrom International Airport (AUS) – Austin, Texas (Corporate Headquarters, Round Rock/Austin Area)

Money Moves:

Dell Technologies’ corporate jet departed from San Jose and flew to Austin — a core corridor connecting Silicon Valley’s innovation ecosystem with Dell’s central command hub in Texas. This route almost certainly reflects executive or engineering leadership travel tied to partnerships, technology integrations, or investment discussions with West Coast partners.

The most accurate interpretation: this trip likely carried senior executives in product development, supply chain, or cloud infrastructure divisions returning from meetings with strategic partners such as NVIDIA, Intel, or major data center operators. As Dell continues to expand its role in AI infrastructure, edge computing, and enterprise hardware ecosystems, coordination between California’s tech firms and Texas’s manufacturing and operational base remains vital.

The timing — mid-October — fits Dell’s fiscal and product roadmap cycles, when teams finalize Q4 strategic initiatives and 2026 innovation budgets. The direct flight into Austin underscores the precision of Dell’s executive travel model: efficient, confidential, and tightly aligned with ongoing R&D and market development priorities.

From the glass offices of Silicon Valley to the tech corridors of Austin, this flight captures Dell’s defining duality — a Texas-built company with Silicon Valley speed, engineering depth, and global reach powering the next generation of digital infrastructure.

Owner: U.S. Bancorp (U.S. Bank)

Date: 10/17/2025

Origin: San Francisco International Airport (SFO) – San Francisco, California

Destination: Morristown Municipal Airport (MMU) – Morristown, New Jersey (New York Metro Region)

Money Moves:

U.S. Bank’s corporate jet departed San Francisco and landed at Morristown, a premier private aviation gateway for executives heading into Manhattan or northern New Jersey’s financial corridor. This cross-country route signals executive or client travel tied to institutional banking, capital markets, or wealth management operations, rather than internal logistics.

The most accurate interpretation: this trip likely carried senior corporate, treasury, or investment banking leaders meeting with institutional investors, fintech partners, or regulatory counterparts in the New York metro area. U.S. Bank has been expanding its East Coast commercial and capital markets presence, particularly after integrating MUFG Union Bank, and this trip likely reflects post-merger relationship management or business development initiatives.

The timing in mid-October also aligns with Q4 investor and regulatory planning, as financial institutions prepare year-end disclosures and next-year capital strategies.

From the innovation hubs of San Francisco to the financial arteries of New York, this flight captures U.S. Bank’s modern strategy — bridging its West Coast fintech DNA with East Coast financial depth to compete as a truly national institution.

Owner: Humana Inc.

Date: 10/17/2025

Origin: John C. Tune Airport (JWN) – Nashville, Tennessee

Destination: St. Louis Downtown Airport (CPS) – Cahokia Heights, Illinois (serving the St. Louis metro area)

Money Moves:

Humana’s corporate jet departed Nashville’s John C. Tune Airport and landed at St. Louis Downtown Airport — a short regional route that strongly suggests executive or regional network coordination travel, likely tied to Humana’s Medicare Advantage, provider partnership, or healthcare operations in the Midwest.

The most accurate interpretation: this flight likely carried senior market leaders or network strategy executives visiting regional healthcare systems, provider groups, or insurance partners in the St. Louis area. Mid-October is a crucial window for Humana, as the company intensifies its Medicare Advantage open enrollment and regional sales operations, making in-person coordination with local leadership and brokers a strategic priority.

The use of John C. Tune Airport — a preferred hub for private corporate travel in Nashville — and direct routing to St. Louis Downtown Airport underscores the confidential, time-sensitive nature of field oversight trips. Executives traveling on this route are likely managing regional growth strategies, provider integrations, or compliance reviews across multiple states.

From Nashville’s healthcare corridor to St. Louis’s medical and insurance markets, this flight captures Humana’s operational tempo — executives on the ground ensuring that innovation, network performance, and patient access remain tightly aligned across its expanding regional footprint.

Owner: Exelon Corporation

Date: 10/17/2025

Origin: Chicago Midway International Airport (MDW) – Chicago, Illinois (Corporate Headquarters Region)

Destination: Birmingham–Shuttlesworth International Airport (BHM) – Birmingham, Alabama

Money Moves:

Exelon’s corporate jet departed from Chicago Midway and flew south to Birmingham — a route that almost certainly reflects executive oversight of energy partnerships, infrastructure projects, or regulatory initiatives in the Southeast. While Exelon’s headquarters sits in Chicago, the company’s influence spans multiple U.S. utilities and energy markets, and Birmingham serves as a regional hub for industrial clients, grid modernization work, and renewable energy expansion.

The most accurate interpretation: this flight likely carried senior operations or business development executives to meet with industrial energy customers, utility regulators, or technology partners involved in Exelon’s clean energy transition and grid reliability projects. Alabama’s growing industrial corridor — anchored by automotive, steel, and manufacturing plants — represents an area of growing opportunity for Exelon’s commercial energy solutions and consulting divisions.

The direct flight from Midway underscores the company’s agile, executive-level engagement with key markets beyond its traditional utility footprint. These site visits often combine strategic relationship building with regulatory groundwork for future energy infrastructure deployment.

From the skyscrapers of Chicago to the industrial heart of Alabama, this flight reflects Exelon’s evolving mission — a modern energy leader balancing clean innovation, industrial demand, and operational excellence across America’s power grid.

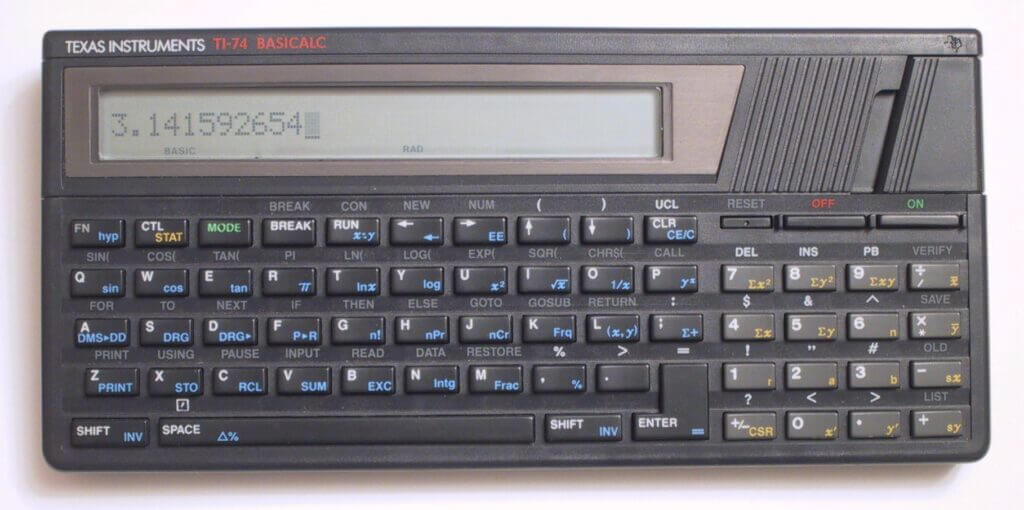

Owner: Texas Instruments Incorporated (TI)

Date: 10/17/2025

Origin: McKinney National Airport (TKI) – McKinney, Texas (Corporate Headquarters Region – North Dallas)

Destination: Yampa Valley Regional Airport (HDN) – Hayden, Colorado (serving Steamboat Springs)

Money Moves:

Texas Instruments’ corporate jet departed its North Dallas base in McKinney and flew northwest to Yampa Valley — a route that suggests executive travel for strategic offsite meetings, investor retreats, or senior leadership gatherings, not operational logistics. Yampa Valley serves the resort area of Steamboat Springs, a popular and secluded destination for corporate planning sessions, board retreats, and executive summits away from public visibility.

The most accurate interpretation: this trip likely carried C-suite leadership or key division heads for a closed-door executive retreat or long-range strategy meeting. With Texas Instruments continuing to expand its semiconductor fabrication investments, R&D capacity, and global supply resilience, October marks the window when the company’s leadership typically reviews capital allocation, manufacturing roadmaps, and technology priorities for the year ahead.

The flight’s direct routing from TI’s McKinney base to Colorado underscores the company’s emphasis on confidential, high-level coordination and executive culture, allowing leaders to align outside the formal corporate environment.

From the semiconductor capital of Texas to the mountain air of Colorado, this flight represents Texas Instruments’ leadership in motion — engineers turned strategists, mapping the future of analog and embedded technology under the quiet peaks of Steamboat Springs.

Owner: McDonald’s Corporation

Date: 10/17/2025

Origin: Frankfurt am Main Airport (FRA) – Frankfurt, Germany (European Operations Hub)

Destination: Republic Airport (FRG) – Farmingdale, New York (Corporate Aviation Gateway)

Money Moves:

McDonald’s corporate jet made the transatlantic trip from Frankfurt to Republic Airport on Long Island — a signature executive route reflecting top-level coordination between the company’s European operations and its U.S. leadership team. Frankfurt serves as one of McDonald’s central command points for its European supply chain, real estate, and franchising divisions, while Republic Airport provides private, low-profile access to the New York metro area for senior corporate traffic.

The most accurate interpretation: this flight likely carried executives from McDonald’s international management team or global supply chain division, returning from strategic planning sessions or franchise partner meetings in Europe. The timing, mid-October, aligns with McDonald’s internal Q4 forecasting and global budget reviews, as leadership integrates European and North American performance data ahead of fiscal-year close.

Landing at Republic Airport rather than a major commercial hub underscores the confidentiality and precision of McDonald’s executive logistics — ensuring swift access to New York-based financial partners, franchise stakeholders, and media agencies without the delays or visibility of JFK.

From Frankfurt’s financial skyline to the hangars of Long Island, this flight captures McDonald’s global operational pulse — a corporate empire bridging continents daily, balancing franchising strategy, capital markets, and brand power at 40,000 feet.

Owner: Aramark Corporation

Date: 10/17/2025

Origin: Philadelphia International Airport (PHL) – Philadelphia, Pennsylvania (Corporate Headquarters)

Destination: Westchester County Airport (HPN) – White Plains, New York (New York Metro Region)

Money Moves:

Aramark’s corporate jet departed from its Philadelphia headquarters and touched down at Westchester County Airport — a short but strategically significant route that signals executive-level travel for client relations, investor meetings, or partnership discussions in the New York area. Westchester offers discreet, rapid access to Manhattan’s financial district and major institutional clients, making it a top choice for Fortune 500 travel.

The most accurate interpretation: this flight likely carried C-suite executives or business development leaders for meetings with key corporate clients, hospitality partners, or financial institutions connected to Aramark’s food services, facilities management, and uniform services divisions. Given the October timing, this trip may have also coincided with earnings-related investor briefings or end-of-year contract negotiations with major clients based in New York and Connecticut.

The routing reflects Aramark’s dual operational identity — rooted in large-scale service execution from its Philadelphia base, yet deeply intertwined with Wall Street, hospitality, and corporate clients across the Northeast corridor.

From Philadelphia’s command center to the corporate towers of New York, this flight illustrates Aramark’s hands-on executive rhythm — bridging service, finance, and strategy in one seamless, well-timed hop.

Owner: Weyerhaeuser Company

Date: 10/17/2025

Origin: Pittsburgh International Airport (PIT) – Pittsburgh, Pennsylvania

Destination: Boeing Field / King County International Airport (BFI) – Seattle, Washington (Corporate Headquarters)

Money Moves:

Weyerhaeuser’s corporate jet departed Pittsburgh and returned to Boeing Field — the preferred executive airport for Seattle’s major corporations, including Weyerhaeuser’s global headquarters. This cross-country flight likely represents senior leadership travel tied to capital markets, timber operations, or industrial client relations in the eastern U.S.

The most accurate interpretation: the trip likely carried executives overseeing Weyerhaeuser’s Eastern Timberlands or Wood Products divisions, returning from meetings with steel, construction, or packaging clients in Pennsylvania and the Appalachian region. Pittsburgh’s industrial economy — anchored in manufacturing, energy, and building materials — remains one of Weyerhaeuser’s key customer regions for lumber and engineered wood products.

The mid-October date points to year-end operational reviews and client negotiations, particularly relevant as housing demand, lumber pricing, and commercial building activity head into seasonal transitions. The direct return to Boeing Field reflects Weyerhaeuser’s efficient, low-profile executive operations—keeping leadership connected between its nationwide forest assets and Seattle’s strategic command center.

From the wooded ridges of Pennsylvania to the evergreen skyline of Washington, this flight captures Weyerhaeuser’s enduring identity — a century-old timber titan balancing field-level forestry with boardroom strategy, linking America’s forests, factories, and financial hubs in one smooth climb.

Owner: Deere & Company (John Deere)

Date: 10/17/2025

Origin: Des Moines International Airport (DSM) – Des Moines, Iowa

Destination: Boeing Field / King County International Airport (BFI) – Seattle, Washington

Money Moves:

John Deere’s corporate jet departed Des Moines—one of its key Midwest operational and agricultural centers—and headed west to Boeing Field in Seattle, a flight path that points to executive-level industrial or technology coordination rather than routine logistics. Boeing Field is frequently used by major manufacturers and defense contractors, suggesting this trip was part of Deere’s ongoing push into autonomous systems, precision technology, or advanced manufacturing partnerships.

The most accurate interpretation: the flight likely carried senior engineering, R&D, or corporate development leaders for high-level meetings with aerospace or tech partners—potentially related to Deere’s expansion into AI-driven machinery, sensor integration, and advanced materials applications. Seattle’s innovation ecosystem, which includes heavyweights in cloud computing, robotics, and aerospace manufacturing, aligns directly with Deere’s digital-farming and automation strategy.

The mid-October timing also fits Deere’s internal calendar for strategic planning, year-end tech budgeting, and supplier-partner evaluations.

From Iowa’s cornfields to Washington’s aerospace corridors, this flight underscores Deere’s transformation from a legacy equipment maker into a frontline industrial-tech company—where precision agriculture meets the innovation DNA of Silicon Valley and Seattle.

Owner: AbbVie Inc.

Date: 10/17/2025

Origin: Waco Regional Airport (ACT) – Waco, Texas

Destination: Waukegan National Airport (UGN / KUGN) – Waukegan, Illinois (Corporate Headquarters Region – North Chicago)

Money Moves:

AbbVie’s corporate jet departed Waco and flew north to Waukegan, the private aviation hub serving its North Chicago headquarters. This route is far from routine, suggesting executive-level travel tied to biomanufacturing, research partnerships, or government relations in the southern U.S.

The most accurate interpretation: this trip likely carried senior manufacturing or operations executives returning from site visits or partnership discussions with contract manufacturing and clinical trial facilities in Central Texas. Waco and its surrounding region host several biopharmaceutical suppliers, packaging firms, and logistics hubs that support large-scale drug distribution.

Given AbbVie’s expanding global portfolio — including immunology, oncology, and neuroscience pipelines — and the timing in mid-October, this trip may also reflect end-of-year operational reviews or inspection tours tied to ongoing FDA compliance and manufacturing capacity planning.

The direct flight to Waukegan, minutes from AbbVie’s global HQ campus, signals a return to the company’s central leadership base for internal debriefings and strategic oversight sessions.

From Texas’s industrial corridors to the laboratories of North Chicago, this flight captures AbbVie’s operational heartbeat — precision logistics, disciplined oversight, and leadership connectivity that sustain one of the world’s top biopharmaceutical innovators.

Owner: Kohler Co.

Date: 10/17/2025

Origin: Chicago Midway International Airport (MDW) – Chicago, Illinois

Destination: Sheboygan County Memorial Airport (SBM) – Sheboygan, Wisconsin (Corporate Headquarters)

Money Moves:

Kohler’s corporate jet departed Chicago Midway and returned north to Sheboygan — a concise but strategic route that likely marks executive or client travel between major design, retail, or hospitality meetings in Chicago and the company’s global headquarters campus in Wisconsin.

The most accurate interpretation: this trip likely carried senior leadership, design directors, or hospitality executives concluding partnership meetings with architects, real estate developers, or luxury retail partners in downtown Chicago. Kohler’s business lines — spanning kitchen and bath design, energy systems, and resort hospitality — maintain extensive corporate and client relationships in the Chicago metro area, making this a frequent corridor for executive operations.

The short distance and private routing to Sheboygan County Memorial Airport, adjacent to Kohler’s headquarters village and manufacturing complex, suggest a direct return for executive debriefs or weekend strategy sessions following business development engagements.

From the skyline of Chicago to the manicured grounds of Kohler, Wisconsin, this flight reflects the company’s unique balance of artistry and engineering — a privately held industrial icon where design, craftsmanship, and global brand strategy meet just 40 minutes above Lake Michigan.

Owner: Dow Chemical Company (Dow Inc.)

Date: 10/17/2025

Origin: MBS International Airport (MBS) – Midland, Michigan (Corporate Headquarters)

Destination: Los Angeles International Airport (LAX / KLAX) – Los Angeles, California

Money Moves:

Dow Chemical’s corporate jet departed its headquarters base in Midland and flew cross-country to Los Angeles — a long-haul route that almost certainly signals executive-level engagement with major industrial, environmental, or commercial partners on the West Coast. LAX, while typically commercial, also handles a steady volume of corporate and governmental arrivals through its private aviation facilities, suggesting a purpose-built mission rather than routine repositioning.

The most accurate interpretation: this trip likely carried senior executives in corporate affairs, sustainability, or materials science divisions for high-level meetings with technology, energy, or packaging partners, as well as potential ESG and climate-related briefings with California’s regulatory and environmental agencies. Dow’s West Coast partnerships include advanced materials collaborations with clean-energy firms, electric vehicle manufacturers, and film-production suppliers, all consistent with this travel pattern.

The October timing suggests it may have been tied to Q4 innovation summits, contract renewals, or government outreach sessions related to Dow’s global sustainability goals.

From the chemical corridors of Michigan to the innovation coasts of California, this flight underscores Dow’s modern transformation — a century-old industrial powerhouse evolving into a sustainability-driven science and materials leader with global reach.

Owner: Wegmans Food Markets, Inc.

Date: 10/17/2025

Origin: Greater Rochester International Airport (ROC) – Rochester, New York (Corporate Headquarters)

Destination: Westchester County Airport (HPN) – White Plains, New York (New York Metro Region)

Money Moves:

Wegmans’ corporate jet departed its Rochester headquarters and landed at Westchester County Airport — a route that signals executive travel tied to expansion, real estate, or supplier relations within the New York metropolitan area. Westchester serves as the perfect private gateway for accessing Manhattan, Long Island, and northern New Jersey, where Wegmans continues to scale its high-end grocery presence.

The most accurate interpretation: this trip likely carried senior executives from development, finance, or regional operations visiting existing or planned store sites, investment partners, or real estate developers. Wegmans has been steadily expanding its footprint throughout downstate New York, with new locations in Manhattan, Harrison, and Brooklyn, making this flight a likely component of ongoing project reviews, lease negotiations, or market performance assessments.

The timing — mid-October — aligns with Wegmans’ year-end capital planning cycle, as leadership evaluates store profitability, supply logistics, and future growth zones before closing the fiscal year.

From Rochester’s corporate nerve center to the affluent suburbs of Westchester, this flight captures Wegmans’ evolution from a regional grocer to a national premium food retail brand — blending family ownership, logistical mastery, and luxury-level customer experience.

Owner: Meijer, Inc.

Date: 10/17/2025

Origin: Gerald R. Ford International Airport (GRR) – Grand Rapids, Michigan (Corporate Headquarters Region)

Destination: DeKalb County Airport (GWB / KGWB) – Auburn, Indiana

Money Moves:

Meijer’s corporate jet departed its home base in Grand Rapids and flew south to DeKalb County Airport in Indiana — a route that signals operational or logistics-focused executive travel. DeKalb County sits in the industrial heart of the Midwest, surrounded by regional distribution hubs, manufacturing partners, and retail infrastructure projects that feed Meijer’s supply chain network.

The most accurate interpretation: this flight likely carried senior operations, construction, or real estate executives overseeing distribution expansion, supplier coordination, or site development reviews for upcoming stores or logistics facilities. Meijer has been actively strengthening its Indiana footprint, with new store openings and supply-chain modernization efforts across Fort Wayne and northern Indiana — areas easily accessed from DeKalb County Airport.

The timing in October also fits Meijer’s internal planning cycle, as the company aligns 2026 capital projects and store development budgets before year-end. The short, targeted flight suggests an on-the-ground inspection or executive summit with local contractors and logistics partners.

From Michigan’s corporate corridors to Indiana’s industrial backbone, this trip highlights Meijer’s hallmark precision — family-owned agility paired with billion-dollar retail discipline, ensuring every store, warehouse, and regional network operates with Midwestern efficiency and reach.

Owner: Walmart Inc.

Date: 10/17/2025

Origin: Chicago Midway International Airport (MDW) – Chicago, Illinois

Destination: Rogers Executive Airport (ROG) – Rogers, Arkansas (Corporate Headquarters Region, near Bentonville)

Money Moves:

Walmart’s corporate jet departed Chicago Midway and touched down at Rogers Executive Airport — the discreet airfield that serves as the private gateway to the company’s Bentonville headquarters. This flight route is a hallmark of executive-level travel between Walmart’s northern supplier corridor and its command center in Northwest Arkansas, reflecting the company’s intricate coordination between retail operations, logistics, and finance.

The most accurate interpretation: this trip likely carried senior executives in merchandising, vendor relations, or corporate development returning from strategic meetings with major CPG partners and investment banks in the Chicago area. Midway serves as the ideal launch point for quiet, high-stakes supplier negotiations, including partners like Kraft Heinz, Mondelez, and PepsiCo — all headquartered in or near Chicago.

The timing — mid-October — aligns with Walmart’s holiday season readiness and Q4 procurement cycle, when leadership finalizes inventory allocations, promotional strategies, and vendor logistics plans ahead of the busiest retail quarter of the year. The direct routing to Rogers (instead of a larger hub like XNA or Tulsa) emphasizes confidentiality and efficiency, hallmarks of Walmart’s operational discipline.

From Chicago’s corporate boardrooms to the rolling hills of Bentonville, this flight embodies Walmart’s business DNA — precision logistics, relentless supplier engagement, and hands-on executive oversight powering the world’s largest retailer.

Owner: Exelon Corporation

Date: 10/17/2025

Origin: Baltimore/Washington International Thurgood Marshall Airport (BWI) – Baltimore, Maryland

Destination: DuPage Airport (DPA) – West Chicago, Illinois (Corporate Headquarters Region)

Money Moves:

Exelon’s corporate jet departed Baltimore/Washington International and flew west to DuPage Airport — the preferred executive gateway for the company’s Chicago-area headquarters. This route highlights executive coordination between Exelon’s Mid-Atlantic utility operations and its central leadership team in Illinois.

The most accurate interpretation: this trip likely carried senior operations, regulatory, or financial executives returning from oversight meetings at Exelon’s subsidiary utilities, including Baltimore Gas and Electric (BGE), one of its most critical regional assets. The timing suggests high-level discussions related to grid modernization, rate planning, or clean energy transition initiatives — central themes in Exelon’s multi-state utility strategy.

The direct routing to DuPage Airport, just 30 miles from the company’s downtown Chicago headquarters, underscores the confidentiality and precision of the mission — avoiding public hubs in favor of controlled corporate access.

From the power corridors of the Mid-Atlantic to the command center of America’s largest regulated utility, this flight captures Exelon’s corporate rhythm — executives bridging field operations and strategic oversight to keep energy flowing reliably across millions of homes and businesses.

Owner: Northwestern Mutual Life Insurance Company

Date: 10/17/2025

Origin: Clyde Ice Field Airport (SPF) – Spearfish, South Dakota

Destination: Milwaukee Mitchell International Airport (MKE) – Milwaukee, Wisconsin (Corporate Headquarters)

Money Moves: