This article is proudly sponsored by the Business Ethics Team at the University of Texas at Austin!

About Proterra

One of the founding members of MacroHint, the one who is still currently in school, saves a lot of money and additional overall stress by taking public transportation (namely, the city bus) nearly everywhere he goes.

On average, he takes the same bus route every single day, seeing pretty much the exact same bus drivers, the same passengers and also finds himself on the same type of bus day after day.

However, every now and again he will be waiting for his bus at school to take him home and will see other bus lines traveling in and around his university’s campus.

Although he’s only found himself on a Gillig, some of the other campus-centric bus lines have buses that are awfully quiet compared to the Gillig’s he’s used to riding on.

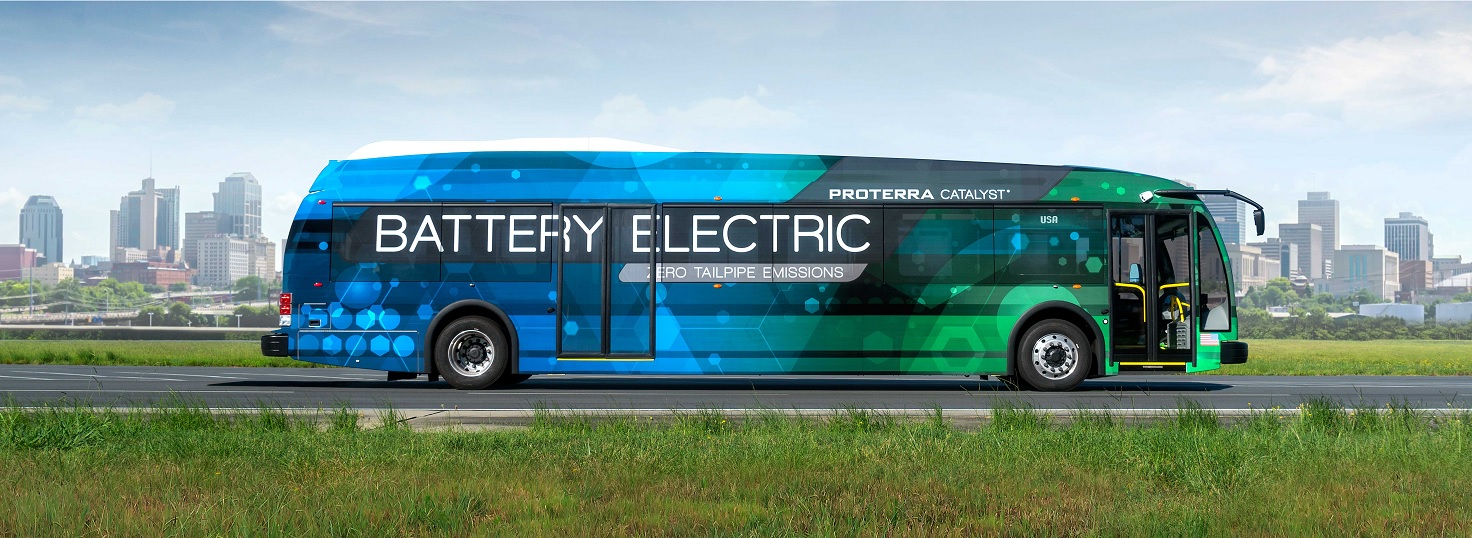

The quiet bus is manufactured by none other than California-based Proterra.

At first blush, the Gillig and the Proterra look nearly the exact same, however, they sure do sound different.

Particularly, while it is more than difficult to try holding a conversation on the Gillig given how loud it is, especially towards the middle and back of the vehicle, the Proterra is just about as quiet as it gets for a vehicle about the exact same size as the loud, clunky Gillig.

If you haven’t figured it out at this point, Proterra is an electric bus manufacturer, primarily operating on the commercial side of things, or in other words, it designs and manufactures electric buses used to carry and transport commuter passengers (no, not school buses), typically in a metropolitan setting, such as Austin, Texas.

Perhaps Proterra’s buses are a lot quieter and perhaps its stock isn’t actually worth its weight in bus, however, we’ll never know unless we get on with this stock analysis article on today’s featured guest, Proterra.

Proterra’s stock financials

With a current share price of a slim $1.24, a market capitalization of $280.74 million along with no present price-to-earnings (P/E) ratio along with no annually distributed dividend to its shareholders at the moment, we have some things worth noting.

First, it is somewhat fun to briefly contemplate the fact that you could either purchase a soda from a nearby vending machine or you could become part owner of Proterra.

Priorities, we guess.

Second and more pressing, we’re not initially swayed one way or another regarding the company’s stock, as we fully presumed that this company, especially since it operates in an investment and debt-heavy space, is evidently focused on retaining and reinvesting as much of its earnings as it possibly can in order to both keep its operations above water and also gradually grow its overall business.

Therefore, we have no complaints about the company or its stock so far, given these preliminary metrics.

Onto Proterra’s balance sheet, the company’s executive team is in charge of $840 million in terms of total assets as well as $324 million in terms of total liabilities.

Candidly, we imagined that this company would be slightly total liability-heavy relative to its total assets given the multitude of expenses, fluctuating costs and simply the equipment-heavy nature of the business in which Proterra operates.

This being the case, we are more than happy to find that the company’s balance sheet is total asset-heavy overall, as it is an inherent signal that this company’s executives are acting as good, financially prudent stewards of its assets as well as its debt(s), especially early on, as this company was founded in 2004.

We have no complaints at all on this front.

As it relates to the company’s income statement, Proterra’s total annual revenue over the last handful of years has apparently been on the rise.

Specifically, Proterra’s total annual revenue was reported as $0 in 2020, around $242.8 million in 2021 and its latest reported figure on TD Ameritrade’s platform, approximately $309.3 million in 2022.

Obviously, anything is better than $0, however, all jokes aside, the company’s total annual revenue growth is likely to continue as more and more municipalities (and transportation systems within) devote funds towards investing in green infrastructure and with that, green transportation, companies like Proterra will certainly stand to benefit in the long run.

With this, it should also be mentioned that as Americans continue facing volatile (automobile) gas prices, it is just as likely that many will migrate away from driving and gradually favor public transportation, which will also be a massive boon for companies like Proterra and inch its total annual revenue up in the coming years.

Of course, this company isn’t completely shielded (by any means) from inflationary, recessionary or other negative macroeconomic pressures, however, these are some of the long-term tailwinds we think will help this company steadily grow its total annual revenues in the intermediate and long-term.

In terms of the company’s cash flow statement, it is no surprise that Proterra has been losing money, or as we’ve fondly referred to it in the past, burning through some cash.

For instance, according to TD Ameritrade’s platform, the company’s net income in 2018 sat at -$34 million, further extending its negative trend to -$250 million in the following year to its latest reported figure of -$238 million, as reported in 2022.

Obviously, the recent and current condition of the global economy hasn’t helped minimize any of this cash burn, however, also being a relatively young company in a particularly equipment-heavy industry doesn’t help either.

From our perspective, it is a bit challenging to definitively say whether or not the company’s net income is going to inch gradually less close to imbuing itself in growing costs and other potentially unforeseen expenses (i.e., rising commodity costs related to manufacturing its buses), however, given the current shape of Proterra’s balance sheet and its recent rise in total annual revenue, we’re not terribly concerned with its current cash burn. Nevertheless, if it doesn’t let up or get closer to positive within the next five to six years, we’d be a bit concerned with the company’s ability to tame its negative cash flow for the years to come.

Proterra’s stock fundamentals

Like its recent net income figures, it appears as though Proterra’s trailing twelve month (TTM) net profit margin has some work to do before getting us even the least bit excited.

Specifically, the company’s TTM net profit margin, according to TD Ameritrade’s platform, is tucked away at -76.92%, in comparison to the industry’s average of 4.56%.

We don’t have to tell you that this is as material of a difference as it gets.

Even though we think there is case to be made that as the company’s bus fleet continues to gain market share in metro America and thus it will be able to reach a positive TTM net profit margin in the long run, we’re still certainly not thrilled that even if the best case scenario unfolds, this company’s ideal, competitive TTM net profit margin is far from exciting, sitting at less than 5%.

This doesn’t exactly compel us to buy and hold this company’s stock (NASDAQ: PTRA) for decades to come.

Lastly, also according to TD Ameritrade’s platform, the company’s TTM returns on assets and investment stand at -26.11% and -32.17% compared to the industry’s averages of 8.31% and 9.09%, both respectively.

We weren’t really surprised by the company’s negative core TTM returns given many of the previously mentioned considerations, such as it being a relatively new company as well as being in an equipment and expense-heavy line of business.

Should you buy Proterra stock?

Buses.

It’s not an all too interesting business, but it is an essential one and thankfully, not one that we see going away anytime soon.

Thinking from a 30,000 foot view, as more and more municipalities and state governments are pressured (or maybe voluntarily opt) to invest in green infrastructure within their respective public transportation operations, we wouldn’t be shocked in the slightest if one of Proterra’s better scaled competitors such as Gillig, Canada-based New Flyer or a few others would consider wholly acquiring Proterra, so as to gain a substantial leg up on its competition and likely heighten its chances of notching contracts with the aforementioned local government entities.

If the company were to be acquired, Proterra shareholders would likely score big, however, we would by no means bank on this or use this as an investment thesis.

Given the company’s recent and current financials, we’re not wooed by this company at this present moment in time, especially as it relates to its overwhelmingly negative TTM net profit margin, its current state of cash burn and the variety of costs (fixed and variable) in this business, we think it is best to give Proterra’s stock a “sell” rating.

DISCLAIMER: This analysis of the aforementioned stock security is in no way to be construed, understood, or seen as formal, professional, or any other form of investment advice. We are simply expressing our opinions regarding a publicly traded entity.