About Applied Materials

And the company with one of the most generic names ever goes to…

We really aren’t trying to roast Applied Materials or its name, but it’s a bit difficult for those who have never heard of the company before to have any sort of reasonable idea or basis as to what the company is and what it does.

Let’s help both of us out and get to know Applied Materials a bit better.

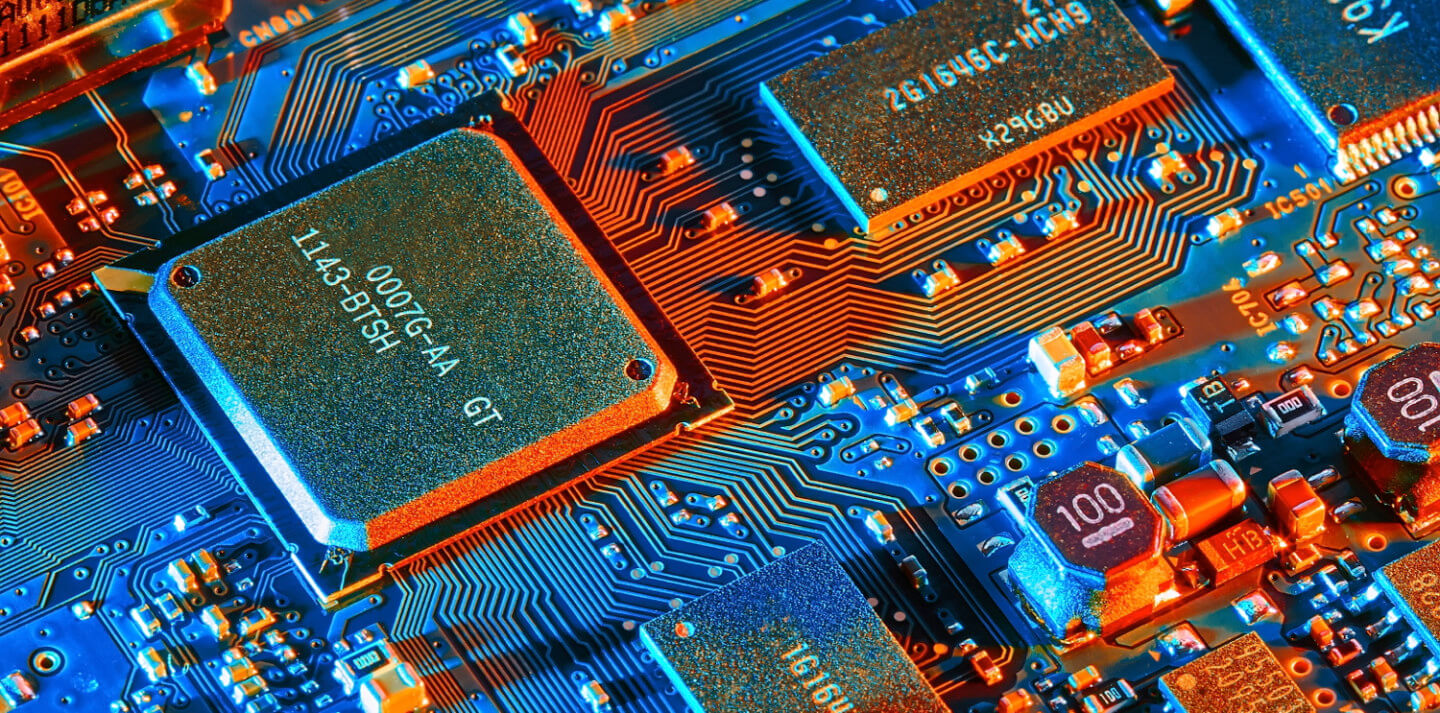

Headquartered in Santa Clara, California and founded in 1967, Applied Materials plays a crucial role in the semiconductor space, which has seen its fair share of press recently. Specifically, “the company provides manufacturing equipment, services and software to the semiconductor, display and related industries,” according to TD Ameritrade’s platform.

In layman’s terms, Applied Materials is a major supplier for those who manufacture and integrate chips into their electronic products, among other types of products and product offerings. At the end of the day, Applied Materials can be thought of as the company that makes the equipment that makes the semiconductors.

Some of the company’s most prominent clientele includes the world’s largest semiconductor manufacturer, Taiwan Semiconductor Manufacturing Company and other major players in the industry such as Intel and Samsung and of course, many others, given Applied Materials’ 16.4% total market share.

These are great clients to have, especially when the economy has seen better periods.

Now that we’ve established a sort of baseline as to what the company does and the importance of its products, let’s dig into the company’s financials and try to figure out whether or not the company’s stock is worth buying and holding for years to come.

Applied Materials’ stock financials

With a market capitalization of $90.1 billion, trading at a share price of almost $104, a price-to-earnings (P/E) ratio of 13.88 and an annual dividend distribution to its shareholders of $1.04, Applied Materials’ stock is off to a good start.

Mainly, we’re pleased to find that the company’s stock is trading below fair value, at least according to its present P/E ratio.

While we’re sure this company has some untapped value to offer its shareholders in the long run, the stock’s valuation is also down most likely due to the company’s recent share price decline of 30% over the past year’s span of time.

This type of phenomenon is great when a quality company is continuing to operate and provide for its customers while the greater overall stock market is tumbling since it creates an inherent opportunity to pick up shares at a discount.

The question remains, of course, whether or not Applied Materials is a quality company and ultimately, a quality stock.

Let’s venture forth!

According to the company’s balance sheet, Applied Materials’ executive team oversees around $26.7 billion in total assets along with $14.5 billion in total liabilities.

Given that this company’s total assets outstretch its total liabilities by a more than healthy amount, we can confidently add a checkmark to the company’s “financially prepared for a recession” box, which isn’t all that surprising given this company’s size and scale but is good to know nonetheless, especially in today’s market environment.

Onto the company’s income statement, Applied Materials’ total revenue over the past five years has been generally rising. Particularly, the company’s total revenue saw a gradual rise between 2019 and 2022, climbing from $14.6 billion to $25.7 billion, respectively.

While a mature company, there is still a lot of pent up demand for this company’s machinery and other offerings which leads us to think this company is going to achieve revenue at or between $24 billion and $30 billion over the next five years.

We view Applied Materials as one of those companies that is structurally important to the semiconductor industry and thus many other industries in which semiconductor products (such as chips) are needed and used. Therefore, we would be far from shocked if the company’s total revenue continued to rise in the intermediate-term.

In terms of the company’s cash flow statement, Applied Materials’ executive team has been able to bag a consistently positive net income over the last half of a decade along with positive and consistent total cash from operations.

We have no complaints whatsoever.

Applied Materials’ stock fundamentals

Even though Applied Materials has a nice slice of market share, they still operate in a brutally competitive market landscape, which makes it all the more impressive that the company has been able to carve a higher trailing twelve month (TTM) net profit margin than that of its industry peers.

Specifically, Applied Materials’ TTM net profit margin is a staggering 25.31% to the industry’s average of 22.01%.

While not too far off from each other, any inch of profitability that can be gained over the competition is valuable to say the least, especially in an industry as competitive as the semiconductor and semiconductor manufacturing industries.

In terms of returns, Applied Materials’ TTM returns on equity, assets and investment are all higher than that of the industry average and we might add, by a considerable amount. For instance, the company’s TTM returns on investment stands at 33.61% compared to the industry’s average of 19.42%, according to TD Ameritrade’s platform.

We initially expected the company’s TTM core returns to be a bit all over the place (given how competitive the market they operate in is) but were subsequently pleased to find that Applied Materials has distinguished and distanced itself quite a ways away from the competition in this regard.

Should you buy Applied Materials stock?

We pegged this company as a dinosaur in the semiconductor production space.

We were sort of right in the sense that the company is a seasoned player in the industry, but were wrong to temporarily assume that this company’s numbers and its other relevant financial figures would be mediocre.

It pays to do research.

Setting aside its overall impressive financial footing, Applied Materials and its services will probably continue seeing heightened demand as the chip shortage progresses and the push for electric vehicles persists as well.

Given the company’s base financials and some of the macroeconomic tailwinds (although there are definitely headwinds), we give this company’s stock a “buy” rating.

DISCLAIMER: This analysis of the aforementioned stock security is in no way to be construed, understood, or seen as formal, professional, or any other form of investment advice. We are simply expressing our opinions regarding a publicly traded entity.