This article is sponsored by College Readiness Consulting!

About Clear Secure

Up until just recently, I haven’t been on an airplane in a minute, as the kids say.

A few weeks ago I flew out to beautiful and sunny Denver, Colorado, visiting popular central regions including the restless town of Denver, an old western style gem by the name of Arvada, the region where the west begins called Golden, suburban and calm Centennial and a military haven with an urban twist labeled as Colorado Springs.

I had a very fun time with my friend who recently graduated from my university and now resides in the area, mainly just scoping out the sights, indulging in some of the good eats in the area and enjoying a more mild summer for a few days in my escape from Austin, Texas, also having the pleasure of intermittently chatting with some of the locals and asking about their lives, whether or not they enjoyed living in Colorado, what they don’t like about it and all that sort of stuff.

My travels began with an early morning flight from Austin, Texas, sitting with my legs tucked sideways in my crammed Frontier Airlines seat (you get what you pay for, I’m not dissin’), hearing the Airbus A320neo engines pur as we raced down the runway, ascending from the ground and charting northwest bound towards The Centennial State.

Upon landing, I was starved and while I like to think I’m in decent shape, every single time I’ve found myself in Colorado (which admittedly isn’t all that much), I can feel the altitude change expeditiously and have to take a few extra breaths once I walk off the plane through the terminal and find myself (not so) mildly huffing and puffing.

Before hopping over to my friend’s place, I needed some food and drink, so I did what anyone would’ve done and walked around the airport and looked for the cheapest food money could immediately buy.

Shoutout to Subway.

I spotted it in my sites but right before I stepped inside to hang with the sandwich artists themselves, I was accosted by an employee adjacent to the nearby Transportation Security Administration (TSA) check-in line and was asked “do you want to try Clear today?”

I adamantly shook then slightly nodded my head once so as to not seem like a jerk, but I was acclimating, hungry and I kind of already knew what Clear Secure was, and I just wasn’t interested in having some long, drawn out discussion about what it was and why I should pay $189 each year to have access to its services and technology.

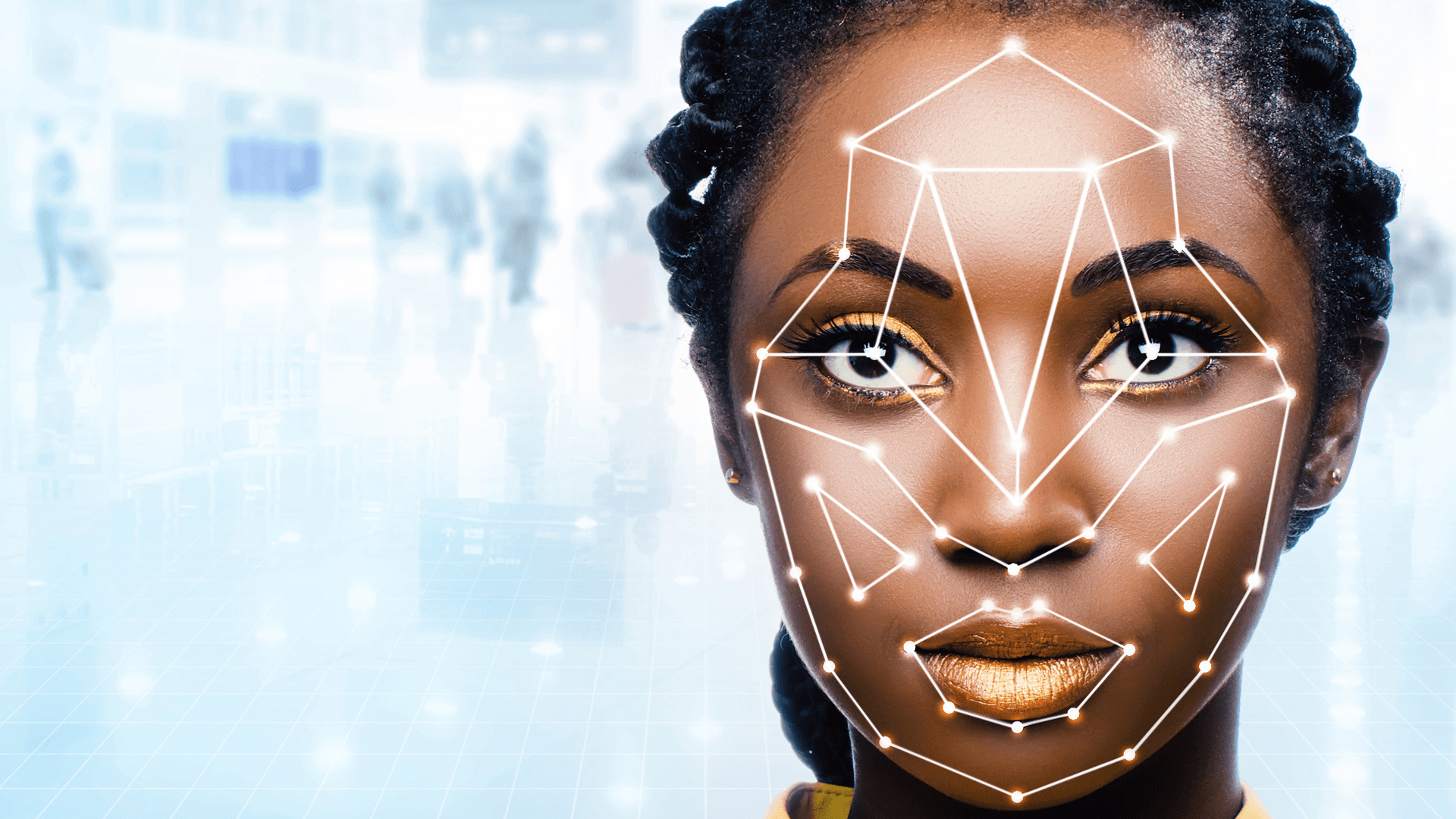

For those that don’t know, Clear Secure is a biometrics scanning technology company that specializes in making it easier for people to get into large-scale venues that tend to be subject to lots of security, airports and concert venues being prime examples.

With most of the company’s business historically coming from setting up its machines in airports, a paying member of Clear Secure could skip the first herds of main TSA identification lines and instead go to their designated Clear area (which is usually very close to the normal TSA lines), have your eyes scanned and fingerprints taken by the machine in order to verify your identity (which you must’ve already given Clear Secure prior to even starting the process in the first place, obviously), then once the machine processes and verifies you are who your identity says you are, you are allowed to proceed to your more formal TSA screening.

I’m going to keep it real with y’all.

Being at Denver International Airport (DIA), I was at one of America’s busiest airports during one of the busiest travel seasons and busiest travel times during the day and the entire identification and TSA process (without using Clear Secure) took like fifteen minutes. Both in the airports in Austin and Denver, the initial identification process involved just showing a TSA agent a copy of my official photo identification and then in a matter of a handful of seconds getting siphoned off into the more formal TSA screening process (when you take your shoes off, get scanned, etc..).

This led me to believe that the use case for Clear Secure was actually pretty weak, but like many things as they relate to investing, it doesn’t really matter all that much if I like a product or service or not, but ultimately what the masses think over longer periods of time.

That remains to be seen.

At any rate, the company makes money mainly by selling the aforementioned annual membership packages, also partnering with various airlines and airports helping them get their machines and apparently employees out in front of travelers.

While I tip my hat off to this company for designing and selling such a high-tech machine, I’m not going to be interested in this company’s stock (NYSE: YOU) until I learn more about the financial figures driving this company, and while my hopes aren’t very high in terms of profitability at the moment, I’d like to see copious amounts of annual revenue growth and just a little free cash flow coming out of this company.

Here’s hoping.

Clear Secure’s stock financials

In getting started with Clear Secure, it can be found that the company has a stock price of $29.56 and an accompanied market capitalization of $4.12 billion along with a price-to-earnings (P/E) ratio of 38.96 and not a regularly issued annual dividend in sight, the lattermost piece of this initial rundown being something I expected before even doing a financial deep dive into this company.

Kidding!

To my absolute and utter surprise, this younger technology company (founded in 2010) actually does pay out an annual dividend to its shareholders, particularly in the quarterly order of $0.10, telling me that either this company’s executive management team is absolutely crazy and just draining cash for the heck of it or this company, to yet another potential surprise, is cash flow positive, so much so that it can afford to drain some cash in the form of a dividend each fiscal quarter.

If you’ve been reading my articles for even a short period of time now, you already know I am going to be checking up on the company’s total cash from operations as they are shown on its cash flow statement so as to gain a better understanding of this company’s ability to pay out said dividend, you just sit back and wait.

At any rate, when it comes to the company’s present price-to-earnings ratio, Clear Secure’s shares (NYSE: YOU) seem to be overvalued, however, its price-to-earnings ratio is still somewhat close to the commonly held fair value benchmark of 20, implying that if there happens to be some rather strong annualized revenue growth behind this company, reasonably pondering paying a premium for an ownership stake in the enterprise isn’t all that farfetched nor unreasonable.

Again, I’ll be checking on this in a minute.

However, before I do, let’s take a relatively quick look at the shape of the company’s balance sheet, as Clear Secure’s executives are in charge of tending to and strategically managing just north of $1 billion in terms of total assets along with $812 million in terms of total liabilities, which, all things considered, is a good, not great, balance sheet, with the company’s total assets outweighing its total liabilities by not all that wide of a margin, but this was likely always going to be case since Clear Secure is probably in the process of growing its unit footprint and with that, hopefully its revenues, costing this company a pretty penny, necessitating it to attach some debt onto its books in order to sufficiently finance its current and future operational hopes and ambitions.

So long as the company’s executives remain responsible stewards of Clear Secure’s debt and closely monitor both current and future levels while sustaining growth in the process, I am not going to be losing much (if any) sleep over the greater overall state of the company’s balance sheet knowing that this is a specialized technology company that is probably growing.

I also take a bit of general comfort in knowing that the company is still total asset-heavy in relation to its outstanding debts and other liabilities.

At any rate, regarding the condition of the company’s more recent annual revenue figures, Clear Secure’s income statement shows us that the company has been growing its revenues at a great annual pace between the years of 2019 and 2023, starting out at $192 million 2019, subsequently reporting $231 million in 2020, $254 million in 2021, $437 million in 2022, leading up to its latest reported figure of $614 million, as, of course, reported and displayed for the year of 2023.

I asked for growth and boy did I get growth, and more than I was expecting, in all honesty.

It appears as though this company has been getting its machines into more and more venues, also alluding to the fact that those that do initially sign on with Clear Secure find themselves staying on with the company and its products, which is a great sign in its own right.

On the basis of valuation and its recent annual revenue figures alone, I personally deem the company’s revenues to be growing quick enough each year to adequately justify buying in at the current valuation levels (specifically according to its price-to-earnings ratio).

Nevertheless, me and you, we still have some more facts and figures to look into as they relate to Clear Secure.

Primarily, according to its cash flow statement, Clear Secure’s total cash from operations, also as measured during and between 2019 and 2023, have been moving in a good direction, especially following COVID, reporting cash flows in the amount of $70 million in 2021, $168 million in 2022, leading up to its latest reported figure of $225 million in 2023, which, to me, is a nice corresponding chunk of its aforementioned revenue figures, telling me that Clear Secure might just be a little bit more cash flow generative that I initially anticipated.

Also, it is plane (get it?) awesome that Clear Secure is cash flow positive in the first place, and it is actually growing its annual cash flows, well that’s just the cherry on top.

Clear Secure’s stock fundamentals

In working on perhaps verifying the strength of this company’s net profit margin through briefly mulling over the company’s figures, according to Charles Schwab’s platform, Clear Secure’s net profit margin stands at a much better than expected 13.67%, as really with my initial assumptions surrounding the amount of capital this company was likely to burn through in relation to its associated revenues, notching a net profit margin north of 10% is stellar and confidence invoking, also indicating that its cost of acquiring customers (shoutout to Mr. Wonderful) are fairly low, not to mention that the company is simply able to sell its machines and related products at a price that is significantly higher than it costs the company to produce, which, sure, is the basic definition of a profit margin, but at this sort of rate and this early on, that is impressive.

Should you buy Clear Secure stock?

In putting all of the ingredients together, Clear Secure is a pretty delicious looking dish.

Primarily, the company’s net profit margin is in tall stature, both its most recent annual cash flows and revenues have been growing like hotcakes, its balance sheet is in good, expected condition and with the melding of further integration between artificial intelligence and biometric technology, it isn’t hard to see that there a lot of future opportunities for a company such as this one.

While the company’s stock (NYSE: YOU) is objectively overvalued at the moment in relation to the sum of its parts, given the previously outlined stats and trends driving this company, I think there’s a greater chance of one regretting not taking a closer look at this company as a long-term investment opportunity than not.

Thus, the “buy” rating.

DISCLAIMER: This analysis of the aforementioned stock security is in no way to be construed, understood, or seen as formal, professional, or any other form of investment advice. We are simply expressing our opinions regarding a publicly traded entity.

© 2024 MacroHint.com. All rights reserved.