This article is sponsored by College Readiness Consulting!

About FICO

Headquartered in beautiful Bozeman, Montana and founded in 1956, Fair Isaac International, better commonly known as “FICO,” is such a profound and frankly beautiful example of boringness, consistency and continuous compounding stemming off of the back of a steady and sound line of business.

While my end goal isn’t to romanticize what FICO does, I have no qualms in admitting that for a nerd such as myself, FICO has so much to offer and boy has its stock price sang melodiously over the last few years, notching a nearly 100% return over the last twelve months alone, and if you would’ve decided to invest in and hold onto the company’s stock (NYSE: FICO) five years ago, you would’ve been up just about 355%.

The chart is just lovely, my friends.

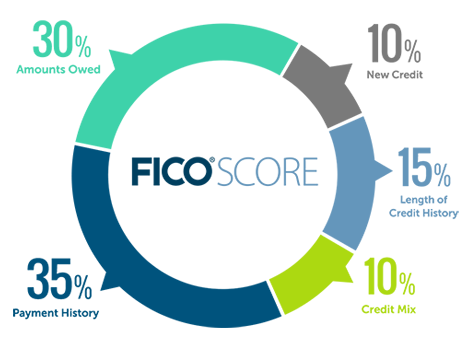

At any rate, for those who aren’t as familiar with FICO as they initially hoped, it is essentially a specialized, data-driven software platform that specializes heavily in collecting, storing and ultimately selling (right or wrong) data, analytics and other information as it specifically pertains to one’s credit.

The company ultimately helps other companies that request and/or need credit information on a prospective client, tenant, or whatever the setting may be, better assess the risks they are assuming on the dominant basis of one’s credit history.

Therefore, it only makes sense that receiving payment for this sort of access is a major (and literally a majority) revenue driver for Fair Isaac, but it is also definitely worth mentioning that the agency also produces revenue through charging individuals for downloading and obtaining their own credit reports, also offering more supplemental but increasingly ascribed to fraud protection plans meant to keep one’s personal scores and reports and other private financial details safe, sound and stored.

Lastly, this impressive and increasingly essential company is seemingly only in the early stages of churning out revenues through its work and capabilities in the Cloud, specifically as it relates to helping its business clients better assess the risks they are assuming with each and every one of its clients requesting credit and predictive future behaviors thereof, not to mention also helping companies on the cybersecurity front in this realm as well, yet another rapidly growing business category.

While it is rather difficult to track down some of the company’s exact clients, it is more than safe to say that of FICO’s more prominent and well known enterprise clients, they include the likes of large banking institutions, which could be anything from a commercial or consumer bank, as well as any sort of mortgage company or practically any other well known outlet that is tasked with managing risk as it relates to the funds it lends out, evidently including insurance companies, among others.

The good thing for this company is the fact that until the end of time, the data it holds is the data many will continue to seek, and with respect to the company’s future performance, it is more so a matter of how much more frequent (or less, on the other side of the coin) do the aforementioned businesses wish to retrieve FICO scores, not to mention how often individuals want or need to obtain and/or send over their credit information.

As one might imagine, while Fair Isaac runs a very reliable and depended upon business, it is still subject to economic slowdowns (i.e., I won’t necessarily need a copy of my most up-to-date credit score report if the real estate market is unfavorable and I can’t afford a home to begin with, however, if the real estate sector were performing well and I was in the market for a home, then I’d absolutely need a report, which more often than not means cha-ching for a company like FICO), but with its expansion into the Cloud and cybersecurity, both seemingly acting as revenue growth drivers and inherent revenue and greater overall economic buffers, I certainly like where this company is heading.

Before proceeding any further, allow me to tell you more about this company through the channel of its cold and hard numbers, which will ultimately assist us in determining whether or not this company’s stock (NYSE: FICO) is worth earnestly considering as an investment to not only buy and hold for your lifetime, but for your next generations, and their next generations and, well, you get the point.

FICO’s stock financials

In kicking off this stock analysis article, FICO is a $42.9 billion company according to its present market capitalization, while also maintaining a corresponding stock price of an objectively lofty (by anyone’s standards) $1,749.54 (yes, for a single share of stock), a price-to-earnings (P/E) ratio of 92.08 all while not currently paying out a dividend to its shareholders at the moment.

First of all, it appears as though Fair Isaac’s stock (NYSE: FICO) is trading at an all too healthy of a premium, with particular reference to its present price-to-earnings ratio being over sixty points greater than that of the standard, commonly held fair value benchmark of 20, where it is widely said that any value greater than 20 indicates that a security is trading at a valuation that is above that of its actual, respective sum-of-the-parts value.

In regular human terms, I am saying that it seems that FICO’s stock is overvalued, and in a big way, as a matter of fact, which definitely checks out given my previous statements surrounding its tremendous stock price appreciation in very recent history.

Nevertheless, despite FICO’s incredible run up to this point, one could perhaps justify paying a premium for an ownership position in this company, that is, if it is growing its annual revenues at a quick enough rate, which I will be checking on momentarily.

But first, as it relates to the overall shape of the company’s balance sheet, FICO’s executive team is guiding a company with just under $1.6 billion in terms of total assets and just about $2.3 billion in terms of total liabilities, initially instilling some fear into myself being that this company does technically have more debts and outstanding liabilities than it does assets or things owned, however, when doing a little extra-mile critical thinking and peering over its numbers a bit more tediously, this sort of breakdown starts to make some sense being that it is growing rapidly and thus is employing some debt financing in order to continue growing into its current growth markets, and if I ultimately find that this company turns out a sufficient amount of consistent-to-growing cash flows to cover this sort of overall breakdown, those worries begin to melt, I say.

As it relates to the company’s income statement, FICO’s annual revenues stemming off of and during 2019 have remained quite consistent, which is good in the sense that it cements in my head that it is a very stable, dependable company in terms of revenue generation, especially when considering all of the market undulations and disruptions the economy and consumers therein have faced, but a net negative in terms of its valuation, as it simply seems as though the market has priced far too much optimism into this company’s shares.

More specifically, the company’s revenues have ranged between a relative low of $1.16 billion (2019) and a high of $1.5 billion (2023), which is just plain decent growth but definitely not anything to write home about nor not even close to being enough growth to warrant overpaying this much for an ownership position.

Regarding the company’s cash flow statement, FICO’s total cash from operations (throughout this exact same timeframe) have also been trending in the right direction, offering myself and hopefully other prospective and pondering shareholders a sort of gift in that it is becoming more and more visibly able to slowly, surely and strategically pay down its outstanding debt(s), ranging between $260 million (2019) and $509 million, as reported in 2022.

It tends to always be a good sign when a company is able to tangibly capitalize on its ability to churn cash out from its most recent business operations and particularly in the context of FICO and the current form of its balance sheet and the current growth-oriented phase it finds itself in, you’re hardly going to hear any complaints from me in this sphere.

FICO’s stock fundamentals

According to Charles Schwab’s brokerage platform, Fair Isaac Corporation also has a very, very strong net profit margin, in the exact amount of 29.99%, which is especially sitting pretty when pinning it up against some of its fiercest and just as well established competitors such as publicly traded TransUnion and Equifax, both maintaining respective net profit margins of (not-so-competitive) -3.63% and 10.80%, respectively.

I think it also worth noting that this is FICO’s net profit margin while it is in growth-mode, which leads me to think that as its newer and emerging analytics and cybersecurity platforms continue to develop and eventually mature, it would only lead me reasonably believe that this company’s net profit margin would become beefed up even further once the growth tapers off, which it will at some point.

Should you buy FICO stock?

According to this company’s core numbers, FICO is an incredibly stable business, serving many consumers and enterprise customers that frankly will always more than likely need its services, products and other offerings, and even though it has a fine balance sheet, generally stable-to-growing cash flows and revenues in recent history, a categorically rockin’ net profit margin (that is, on both an individual and comparable basis), its valuation has to be the line in the sand I draw, as I think this company’s stock has too much good and optimism built into it for the time being.

The upside just seems, to me, all too limited at this time.

Hence, my regrettable yet purely objective “sell” rating.

DISCLAIMER: This analysis of the aforementioned stock security is in no way to be construed, understood, or seen as formal, professional, or any other form of investment advice. We are simply expressing our opinions regarding a publicly traded entity.

© 2024 MacroHint.com. All rights reserved.