About Roku

Roku is not as cool as you think it is!

Ok, let us explain.

The term, “disruptive”, has become ridiculously overused as it relates to unicorns.

Specifically, some of these unicorns have been successful as publicly traded companies and made their founders very wealthy (some that come to mind are DoorDash, Uber, Spotify and of course, Roku). However, Roku, unlike many of the previously mentioned companies, is not disruptive.

At its core, Roku is strikingly similar to Amazon Fire TV. It’s a platform that hosts various streaming and media outlets such as Netflix, ESPN+, Peacock, YouTube and many more.

That’s basically it.

While we see Roku as a potential emerging leader in the competitive streaming industry, this has yet to be proven.

Valuation

Roku is overvalued. There’s not much room to argue this fact, as the company currently has a price to earnings ratio floating around 100 (above 20 is said to be overvalued). Another metric that hints at the inflated share price you have to currently pay for Roku is its above industry average price to earnings and growth ratio, also sitting well above its peers.

While valuation is incredibly important, it can be usually cured by a substantial decrease in the stock price, bringing Roku down to a more favorable and fair buying level.

We’ll talk more about this later.

However, share price aside, it’s no secret that a company’s fundamentals tend to tell a lot more about the current and future stories of companies. This being the case, let’s look at Roku’s financials!

Roku maintains a strong balance sheet in terms of its total assets comfortably outweighing its total liabilities.

We love this in a growth company; it’s somewhat rare!

Roku’s net income is also up over 1,000%, mainly attributable to the demand of streaming skyrocketing as people stayed home throughout the past year and a half.

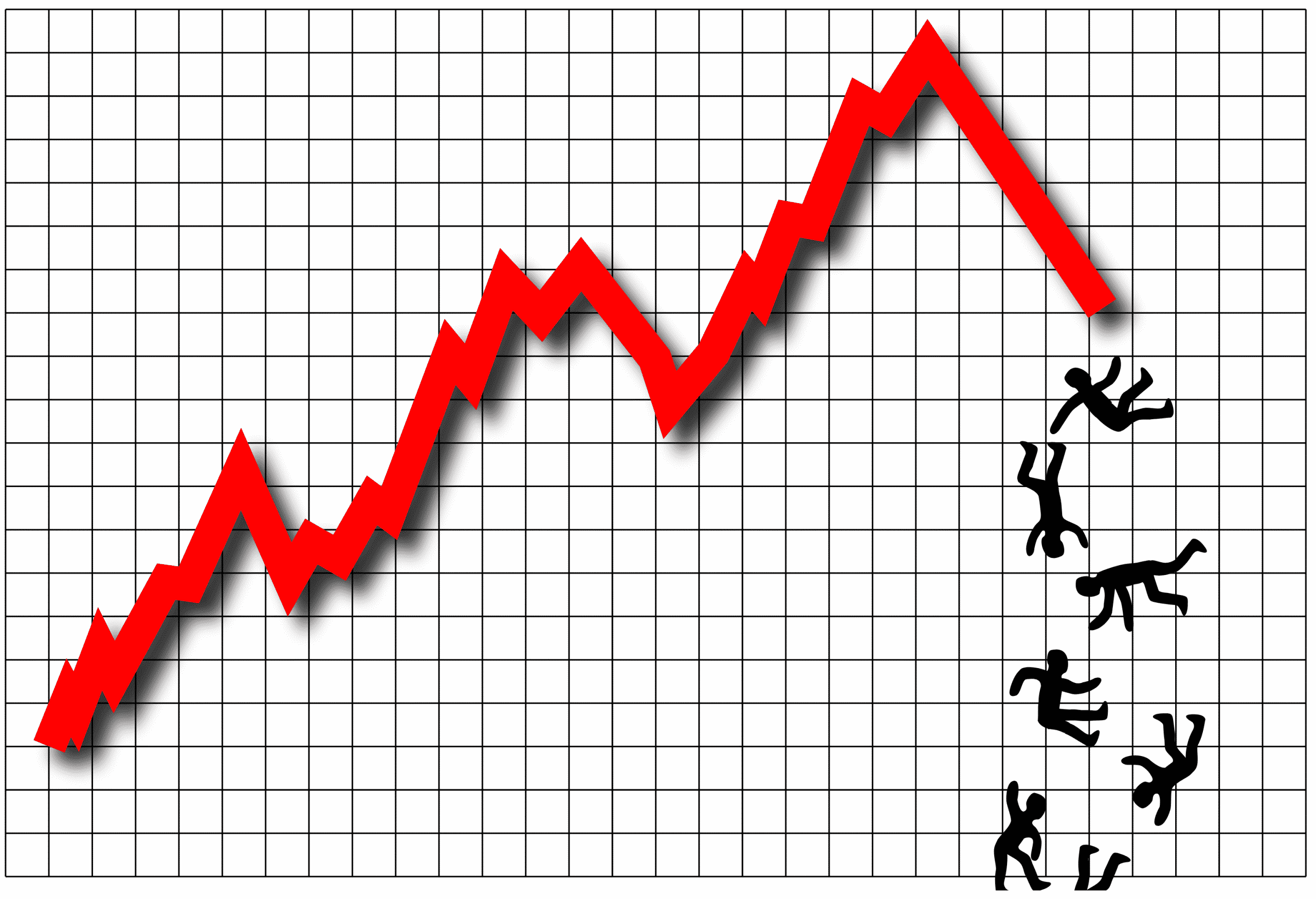

This has indisputably formed a bubble.

Therefore, the company’s growth is unsustainable.

Roku’s Financial Growth

In order for Roku to justify its current share price and its ability to deliver future value for shareholders, they have to absolutely dominate the streaming space (which again, is an already viciously competitive industry), or find an untapped niche as it relates to streaming and dominate.

This will likely be incredibly difficult to do, however, anything’s possible!

We feel the need to mention that Roku’s stock is not exactly for the faint of heart. The stock itself tends to make erratic (upward and downward) share price swings, potentially erasing any previous gains in a matter of a bad market day. In other words, one must consider their financial needs and portfolio volatility tolerance before they hit the buy button on their brokerage platform.

Fast Forward: At the time of this initial writing, Roku (NASDAQ: ROKU) was trading around $300. At the time of the editing process (2/4/2022), the stock is trading at half the initial price, at $150, maintaining a price to earnings ratio of 82 (as opposed to its previous 100).

This is a perfect example of waiting for the stock’s initial bubble of momentum to wane and pop a little bit, allowing investors to potentially pounce on the opportunity of investing when the stock hits new lows.

It should be mentioned, however, that just because a stock falls drastically in price does not mean you are Warren Buffett and have struck gold mine. For this to be true, the company must have some form of sustainable, long-term value and differentiation from its competition.

As previously mentioned, the competition in the streaming industry is cutthroat.

Frankly, it is hard to say whether or not Roku is a smart long-term stock to invest in. However, we find the company to be mostly viable and brand-strong enough that allocating a small size of your portfolio to Roku at these current price levels isn’t a bad idea.

NOTE: Small is different for each individual investor; invest within your own personal risk tolerances and financial means.

The company’s share price historically has proven to be a rollercoaster in the truest sense. The stock’s ride picked up during the pandemic (trading around $100), throughout the course of the pandemic leaping to as high as $459 in late June 2021, to now currently trading (early February 2022) at $150.

The question comes down to intermediate and long-term demand.

Did COVID-19 pump up demand to unattainable, astronomic levels?

This is very hard to say for certain, but we think so.

At first blush, our team saw Roku as a company with little to no differentiation or value, a fad of a stock and brand bubble waiting to be popped.

After further analysis and the recent beating the stock has taken, we’ve reconsidered.

In fact, after some preliminary chart analysis, Roku seems to be doing what a lot of technology growth stocks have done in recent history, coming back to their pre-pandemic stock prices.

Value, fundamentals, and other important company viability and profitability metrics aside, these companies are in essence giving investors a fresh start.

Specifically, many fellow unicorn growth stocks have been humbled to pre-pandemic prices. For example, Spotify’s stock has endured a journey similar to Roku’s in that in May 2020 the stock was trading at around $158, peaking in February 2021 to $365, subsequently freefalling to its current price of (February 2022) $160.

It is by no means a certainty, however, that Roku or other fellow growth stocks will be able to put sufficient, sustainable, long-term value behind their currently somewhat down to earth stock prices. Was (and is) the pandemic too good to Roku?

Subscribers is the name of the game for Roku (and Spotify for that matter).

When the pandemic eventually (hopefully) subsides and people get back outside or go back to work in-person, (watching a lot less TV) and subsequently consider cancelling their streaming services, how will Roku respond?

How can they respond?

So much of Roku’s future success, from our perspective, is tied to the remaining duration of the pandemic. Generally, it’s never great when the future stability and/or success of a company relies heavily on the state of the national and global economy and state of the labor market.

Overall, this is the core of what makes us scared to buy a sizeable amount of Roku stock.

Too many people purchased a Roku device or subscription and once the old normal prevails, they’ll likely have a mass exodus of customers fleeing away from streaming as a whole or just from Roku, finding another less expensive, more accessible streaming service.

This is a very real possibility.

Nevertheless, if you’re willing to risk a little, we don’t think it’s a horrible idea to buy a few shares of Roku if you get in when the price is low ($150-$160) and invest as if you’ve lost that money forever and be as unemotional as you can be.

NOTE: Trade within your own risk tolerances and do your own due diligence! We are just merely expressing our opinion.

The Future of Roku

Roku was a growth company, however, as can be deducted from recent stock movements and a quick glance at its financials, the growth is drying up.

We stand on the principal that if Roku were to drop a considerable amount (give or take $100), it would be a buy. However, given its current share price, the competitiveness of the industry, and the uncertainty as to how long COVID-19 and its variants will remain threats (keeping people inside), the outlook isn’t as favorable as it would’ve been right before the onset of the pandemic.

We initially gave the company a “sell” rating.

Facts have changed in following months.

Fast Forward: The stock did fall $100. Actually, it fell roughly $150. In fact, as a point of reference, Roku is currently trading only $11 above its 52-week low.

While it is next to impossible to precisely time the bottoms of specific stocks or the stock market as a whole, retrospectively, you can see what price action looked like and attempt to gauge what the stock will do going forward.

However, this isn’t meant to in any way sound as it easy as it does.

There is no binary formula for determining when to get into and out of a stock profitably and there never will be. The world is just like stocks; it is filled with volatility, uncertainty, and irrational players.

Your job as a prudent, risk-managing investor is to be objective, future-planning, and unemotional. Let the numbers from the fundamentals of a company’s income statement to valuation metrics and SEC reports speak for themselves.

Given Roku’s share price level as of this publication ($151.80), and our own risk tolerances, we give buying a few shares of Roku (at current price levels) a “buy” rating and putting your entire life savings into the stock an “absolutely do not do that” rating.

Should you buy Roku Stock?

Finally, it is our opinion that given the financial research and opinions we derived from the facts, that it would not necessarily be a bad idea to buy shares of Roku when they’re trading in the $150 price neighborhood. However, in order to enjoy value-based share price gains and compensate for the lack of growth they are likely experiencing and going to experience (ie. only so many people are going to sign up for a Roku subscription at once), the company needs to better differentiate itself before pandemic completely ends and people are spending less time on their TVs and phones.

If they don’t, the bubble will burst.

DISCLAIMER: This analysis of the aforementioned stock security is in no way to be construed as or understood as professional or formal financial and/or investment advice. We are simply expressing our opinions regarding a publicly traded entity.