About Timken

Timken is a company that has been around for quite a while but you’ve likely never heard of them before.

Founded in 1899 in St. Louis, Missouri by who else but Henry Timken, the company has become one of the world’s largest manufacturers of (roller) bearings and power transmission products.

I don’t know what that is either.

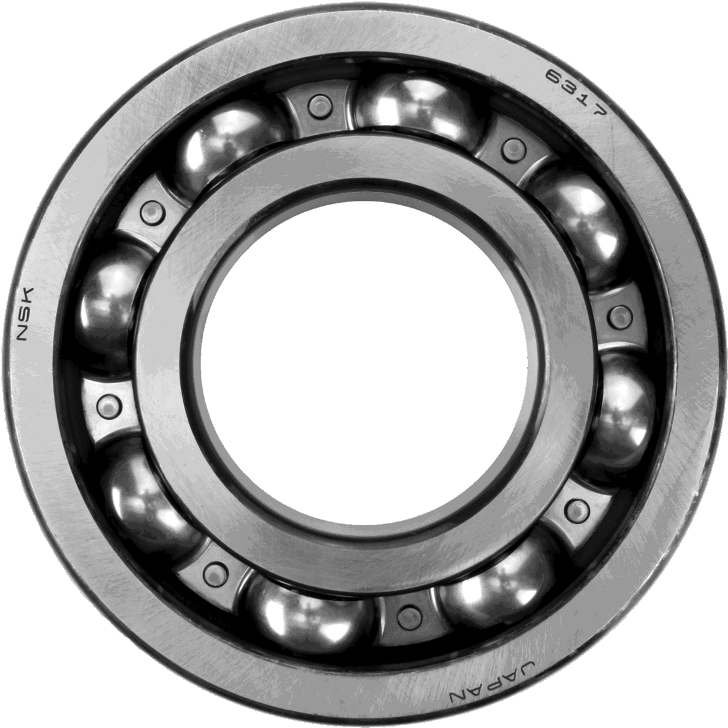

After doing some research, we’ve gathered that roller bearings and bearings in general have applications in various industrial contexts such as car and train wheels and a wide array of machines that rely upon safe, efficient and fluid operation. As it relates to power transmission products, the company manufactures belts, chains lubrication services and many others that are necessary and possibly required for many companies. We’d also like to note that the company apparently operates in the mining, construction and rotorcraft industries. For those who are still interested in learning more about the products offered by Timken, be sure to check out their website for more information.

Nevertheless, we’re fine admitting that while we don’t assert ourselves to be experts on bearings or industrial equipment, however we like to think we have knack for sniffing out whether or not a company’s stock is worth investing in and of course, Timken is the company in question.

Let’s get better acquainted with the company and its financials and see whether or not the future seems promising for Timken and its stock price.

Timken’s stock financials

The company’s stock is currently trading at around $62, with a market capitalization of $4.6 billion, a price-to-earnings (P/E) ratio of around 12 all while currently paying out an annual dividend of $1.24 to shareholders.

At first glance, there appears to be some promise as the company’s share price appears to be objectively undervalued given that its current P/E ratio is notably lower than what is considered to indicate fair value, 20.

Digging a little deeper into the company’s numbers, Timken has a relatively strong balance sheet as its total assets sit at around $5.1 billion and its total liabilities at around $2.8 billion. We initially assumed that the company’s total liabilities would’ve been significantly higher given that much of what they manufacture is subject to cyclical and at times volatile commodity prices (ie., the price of steel, brass etc..). However, no matter the cycle it appears as though the company has a balance sheet that allows them to absorb any cyclical headwinds that might come its way, excluding any extraordinary shocks.

According to the company’s income statement, total revenue has been fairly consistent at around $3 billion (plus or minus) over the past five years, except for their last reported year as total revenue in 2021 spiked up to approximately $4.1 billion.

This spike is revenue was likely due to the company increasing the price of its products and services due to supply chain and pandemic-related complications.

Timken’s stock fundamentals

If generally steady revenue and the stock being currently undervalued wasn’t good enough, Timken also has an inept ability of producing a higher net profit than its competition.

Specifically, the company’s trailing twelve month (TTM) net profit margin stands at 8.92% to the industry’s average of nearly -18%, according to TD Ameritrade’s platform.

Obviously, producing a profit in a hard-to-profit industry is no small feat, even if you happen to be one of the industry leaders.

When it comes to the company’s ability to obtain TTM returns on equity, assets and investment, Timken is generally in line with or slightly lower than that of the industry average. This makes sense given that the company has a lot of operations, projects and machinery across the globe which naturally means they have more equipment to wait to achieve higher returns on.

Time is likely the ultimate cure.

We assume their returns numbers will inch closer to the industry average over time, however we’re not currently worried given that Timken’s core returns aren’t significantly lower than the competition by any means.

Should you buy Timken stock?

This company’s stock price has been steady over the past few years and we don’t see that changing.

Steady revenue and profit numbers are what we think prospective and current investors can reasonably expect moving forward from Timken. If you’re an investor seeking triple digit returns over the next two years, we think you should probably look elsewhere. However, if you’re seeking a stable and seemingly reliable company to invest in, Timken might not be a bad option.

Given that the stock is currently undervalued, well capitalized according to its balance and sheet, maintains diversified operations across the globe and can turn a profit better than other players in the industry, we give the company a “buy” rating.

DISCLAIMER: This analysis of the aforementioned stock security is in no way to be construed, understood, or seen as formal, professional, or any other form of investment advice. We are simply expressing our opinions regarding a publicly traded entity.