About United Therapeutics

And the curiosity and general interest in biotechnology and novel pharmaceutical companies continues.

While we are all too comfortable in admitting what we don’t know or, at least, what isn’t in our relative expertise wheelhouse, a little research never hurt anyone and we do know that more and more individuals across the globe are being afflicted by sicknesses, diseases and other health-related complications that companies such as United Therapeutics are seemingly intent on taking head-on.

Some companies such as the Pfizers and Johnson & Johnsons of the world are known for not just focusing on a handful of treatments or therapeutics but a large array of illnesses and diseases, which we enjoy on some level (from the strict perspective of investor, that is), as diversifying one’s revenue streams can certainly be a positive, we tend to gravitate more towards companies that maintain a nearly singular focus on one area, committing almost all of their resources to such an area and being an expert in, you guessed it, that one area.

This is good for a few reasons, some related to investing and some not.

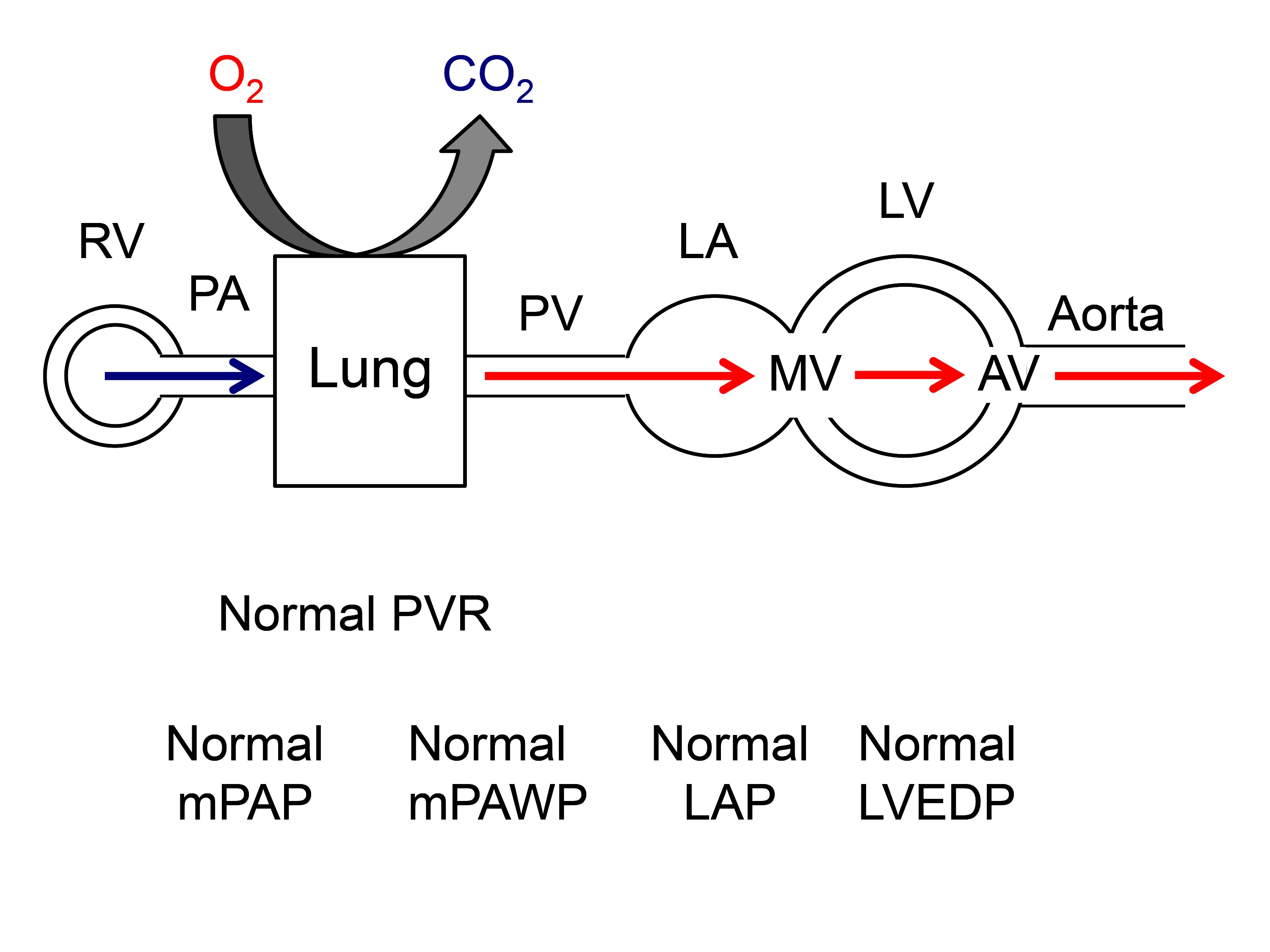

For more practical, important and humane reasons, intense focus and resource allocation to one or a small handful of diseases and/or disorders will likely help society in the long run as it can rest a little better knowing that United Therapeutics is primarily focused on one thing and, really, one thing only; treating and helping those with pulmonary arterial hypertension, otherwise referred to simply as “PAH.”

If one company full of experts is concentrating the vast majority of its resources and energy focusing on treating one specific medical condition that certainly impacts many, we deem that as a net positive, as these sorts of companies are littered with experts in this specific field.

Its pipeline of treatments and statuses thereof can be found through this link on the company’s website.

Additionally, from a business lens, this undoubtedly piques our interest in terms of the mergers & acquisitions (M&A) world, as we think a company with this much expertise and focus on a certain medical area instantly lends itself as being on not Big Pharma’s (because we consider United Therapeutics to already be a part of this group), but Bigger Pharma’s radars as it could be viewed as a very powerful, profitable asset for a larger drug company such as the likes of Pfizer, Lilly, Merck, Novo Nordisk and Gilead, among many others that could afford to wholly acquire United Therapeutics or other specialty players such as Vertex Pharmaceuticals.

Without looking at any of the numbers, these are certainly a few positives going for United Therapeutics, and, unfortunately for humanity, cases of PAH are on the rise worldwide, meaning there is inherently going to be more and more demand for United and its products.

One interesting tidbit about this company is that it was apparently founded by someone who had no previous experience in the pharmaceutical space (previously was the head of Sirius XM) that had a child that was suffering from this medical condition and decided to throw every single thing at helping treat and help their child live a life free of pain and suffering.

Fascinating.

Now, that some of the bases have been covered with this Silver Spring, Maryland-headquartered company, it’s only right that we delve into this company’s core financials and other relevant financial figures, metrics and ratios so as to determine whether or not this biotechnology company’s stock (NASDAQ: UTHR) is worth considering as an investment for both now and later.

United’s stock financials

With a prevailing market capitalization of $10.95 billion, a current share price of $233.26 as well as a price-to-earnings (P/E) ratio of 13.47 and no annually distributed dividend being paid to its shareholders at the moment, United Therapeutics isn’t off to a bad start all given the fact that shares of its stock are seemingly undervalued (albeit modestly) as can be seen by its price-to-earnings ratio being a tad below the standard fair value benchmark of 20.

If you didn’t initially catch our drift, it would serve you well to click on the link above.

Not bad, United Therapeutics, not bad.

Gaining a little more familiarity with the state of this company from a strict financial perspective, it can be found that United’s executive team is tasked with tending to and properly deploying and managing just about $6 billion in terms of total assets along with around $1.2 billion in terms of total liabilities, which is a very well constructed balance sheet given that its total assets outweigh its total liabilities five times over and even though pharmaceutical companies tend to be among the most recession resistant to begin with, it is sort of a double positive to find that this company is still total asset-heavy and subsequently ready for a lot of bad news to come its way, as it can clearly afford to weather any incoming, macroeconomic storms, at least those that aren’t completely and utterly extraordinary in the most literal sense.

As it relates to the company’s income statement, United Therapeutics’ total annual revenues have been as stable as a cucumber (cucumbers aren’t known for their stability, but whatever), as it has found itself generating (since 2018) mid-to-high $1 billion in terms of revenues each year, suggesting that it has continued seeing steady demand for its products and related treatments.

Sad for humanity, good for a company such as United Therapeutics.

From the perspective of United’s cash flow statement, this company has done an excellent job at extracting cash from its operations (again, referencing since 2018) on a consistent basis, however, it can be noted that this company did report negative net income and total cash from operations figures in 2019, which can more than likely be attributed to this company’s costs rising a bit and/or it reinvesting at a more aggressive rate during that era, which can respectively be managed and one also just has to pay to play when it comes to innovating in the specialty pharmaceutical space, which is especially critical for a younger company with a growing pipeline and lots to prove such as United Therapeutics.

United’s stock fundamentals

It is our experience that specialty pharmaceutical companies are able to be more efficient with their capital and other resources as well as generate a trailing twelve month (TTM) net profit margin greater than that of the industry’s averages given their immense treatment focus and their typically leaner operations, say, compared to a much larger pharmaceutical company like Pfizer.

With some experience comes a little intuition, I suppose, as, according to TD Ameritrade’s platform, United’s TTM net profit margin tops the industry’s respective average by a notable amount, with its TTM net profit margin standing incredibly tall (like Victor Wembanyama tall) at 41.29% to the sector’s listed respective average of -464.45%, which is obviously a tremendous difference favoring United Therapeutics.

This speaks to the company’s ability to put together, market and sell profitable treatments and products which is certainly a plus, especially when one considers the industry’s average and just how competitive lower-level players in the industry are, which speaks volumes as to just how successful United has been in the marketplace thus far.

It is also worth mentioning that this company’s (also as displayed on TD Ameritrade’s platform) TTM returns on assets and investment(s) are both significantly greater than those of the industry’s listed averages as well.

For example, United’s TTM return on assets is pegged at 14.26% to the industry’s average of -6.55%.

Should you buy United Therapeutics stock?

Operating in a largely recession proof sector of the economy is an inherent plus, however, taking meaningful steps in attempting to tackle PAH once and for all is a plus to not only this company’s shareholder base but to society as a whole.

In addition to having a great mission, United Therapeutics also maintains incredibly attractive core financials with respect to its TTM net profit margin and returns on assets and investments, its recession-ready balance sheet, its shares (NASDAQ: UTHR) trading at a discount relative to its intrinsic, fair value, its steady year-over-year revenues, among other net positives.

As more and more folks around the world are conflicted with PAH and other related health complications, it seems as though United’s total addressable market (TAM) is growing daily, which is obviously a bad thing for humans but an objective positive for a company such as this one, as it stands to benefit from selling more of its products and treatments to the masses through its continued success and innovation, of which it already has a more than solid track record.

Putting all of this information together, we think it is most fair to give this company’s stock a “buy” rating.

DISCLAIMER: This analysis of the aforementioned stock security is in no way to be construed, understood, or seen as formal, professional, or any other form of investment advice. We are simply expressing our opinions regarding a publicly traded entity.