This article is proudly sponsored by Lake Region State College!

About Wabtec

Wabtec, more formerly known as Westinghouse Air Brake Technologies Corporation, being originally founded in 1999 and came to be as a result of a merger between the Westinghouse Air Brake Company (WABCO) and MotivePower Industries Corporation, is a company that was much nearer and dearer to me than I ever knew prior to the initial drafting of this stock analysis article.

When I was a young child and not in the classroom, shooting hoops or on weekend scoreboard duty, I am almost embarrassed to admit just how many hours I spent standing at my local commuter railroad train station, watching trains zip in and out of the station, voraciously waving at the engineers, practically begging for them to blow their horns and give me a wave back.

I would habitually arrive on the eastern platform at around 5:00 PM, enjoying the golden hour for, well, hours on end, until the horizon began to set in following the outbound rush hour of commuter trains that either trudged in slowly, dropping off and picking up passengers or speeding through (express lines) to the next stop, and a few minutes before 8:00 PM came around and the real anticipation built as one engineer in particular noticed my persistence night in and night out, and one fateful night, like many others, when the horizon was blending, I saw a white rotating beacon light bend around a corner off in the distance, and a minute and some change later, gradually heard the louder and louder purr of the train’s leading EMD F40PH locomotive as it slowly entered the station, and while performing my usual “horn request and wave” act, an engineer I had seen daily tossed a paperback operating procedures manual out from the cab (where the engineer operates in the front of the train) and in it, provided a notecard with his personal contact information and said that if I ever wanted to take a ride in the cab with him, to reach out and we could get it set up.

To me, this was literally the equivalent feeling of how Michael Jordan felt when he won his sixth championship.

I freaked out and probably didn’t sleep a wink that night.

I sort of wish I was kidding and could say that I was just trying to be overly humorous and self-deprecating, but for a railfanner (term simply meaning someone who enjoys watching and/or taking pictures/videos of trains) such as myself, just the mere thought of having an opportunity to get a glimpse into the front of engine and watch the engineer himself operate the large machine, press the buttons, hear the alerters go off, have my own set of earplugs to cherish forever and do something that not many people on this earth have had the chance to do, this ended up being one of the most special, memorable moments of my life.

Obviously, I ultimately reached out, we connected and I got my dream ride in the cab with the engineer that clearly went above and beyond showing me all of the switches, gauges, signals and what I was most excited about, the controls he used in order to operate the train.

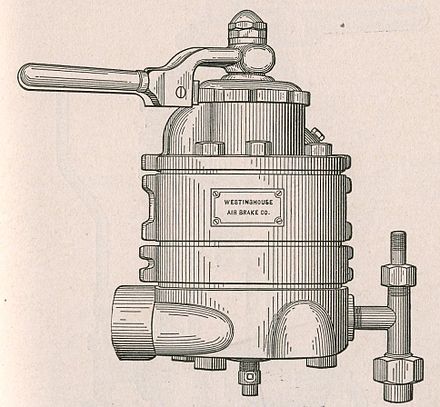

The throttle, the independent brake and the dependent brake, each dancing with one another, guiding the locomotive and the attached passenger cars to the line’s each and every stop and what do you know, some of Wabtec’s products were most definitely involved, among other things, primarily its 26C Brake Valve, 30A-CDW Brake Valve along with its signature Emergency Brake Valve, all of which I can still picture in the cab of the locomotive like it was yesterday.

I don’t think I’ll ever forget.

Simpler times.

Evidently, the aforementioned products are rooted in getting the front engine/locomotive to slow down, but also the cars that it is tugging as well, what is classified as the independent brake specifically controlling the speed of the leading engine or head car and the dependent brake (sometimes also referred to as the automatic brake) adjusting the braking of the rest of the cars that are attached to the head car, all typically being controlled by the controls on one single column that stores the aforementioned throttle (this can basically just be thought of as the accelerator or gas pedal of the train) and brake valves, which, again, can be better seen through the link above.

It is safe to say that Wabtec is indeed a staple in the railroad industry, not only being a company that has an intense focus on manufacturing and selling braking equipment, but also other mission critical parts of trains (think compressors, air filters, couplers, traction motors, aftercoolers, radiators, event recorders and the like), serving both smaller, local commuter lines as well as much larger, equipment-heavy freight railroad and transportation networks, such as Union Pacific, Burlington Northern Santa Fe (BNSF), Norfolk Southern, CSX, Canadian Pacific and many other respected railroads such as Amtrak, largely, I think, cementing itself as nothing short of being an important company in the greater overall context of the supply chain realm, being that as demand for goods and consumers, well, do what they do best and continue consuming at higher rates, someone needs to play an integral role in moving those goods and in a safe manner, and Wabtec is in many respects the one and only solution the aforementioned companies and networks use in order to get this job done.

Sure, it would be rather naive of me to imply that consumer spending doesn’t periodically fluctuate and with that, freight transport demand, however, I think a company such as Wabtec has largely insulated itself from these sorts of constraints and/or pressures, as regardless of economic and/or shopping season, the aforementioned companies are going to still need Wabtec’s products (many in a regulatory context, as these companies do not want to get caught with their pants down on this sort of safety stuff which can lead to bad fines as well as accidents that don’t exactly bode well from a public relations perspective) and if the economy softens and less train engines are lugging goods around the country, it still doesn’t greatly impact a supplier like Wabtec because, hey, they need them, period, end of story, not to also briefly mention that as more and more within the rising generations (think millennials, Gen X, Gen Z, etc..) continue buying stuff they do or don’t need (I’m just calling it how I see it, y’all), freight railroads will need to gradually adjust with this demand and purchase more locomotives and freight cars, and more locomotives and freight cars means more orders for Wabtec.

That was both my little sentimental story as it relates to Wabtec and my thoughts on the company and its business overall, and here is the rest of the stock analysis article that you came to read.

Wabtec’s stock financials

Coming in at $29.23 billion (in terms of its market capitalization, or how much the company is generally said to be worth as of this publication), a relative share price of $165.72 as well as a price-to-earnings (P/E) ratio of 32.24 and paying its shareholders an annual dividend of $0.80, Wabtec’s shares appear to be trading on the pricier side of the price-to-earnings spectrum, as I’ve discussed in past stock analysis articles that it is commonly maintained within the investment community that a P/E of 20 implies that a stock is trading at precisely fair value, or what it is worth paying for today given the sum of its parts, and with that, it is clear that according to this singular metric, an ownership position in Wabtec would prove to be rather expensive relative to its actual worth, or in simpler terms, one would objectively be overpaying for a slice of the Wabtec pie, which does make some sense given its recent impressive stock price appreciation, notching investors a nearly 16% return over the last month’s span of time alone.

Candidly, unless this company’s annual revenues are growing at an attractive enough rate, I don’t get the initial impression that Wabtec is growing at a rate significant enough to justify paying this sort of a premium, given just how seasoned the firm is, but I would sure love to be wrong on this one.

Before figuring this out, however, I’d like to briefly touch on the company’s balance sheet and its overall structure, so as to carve out an initial opinion regarding Wabtec’s current financial stability.

Particularly, Wabtec’s executives are leading this company with just short of $19 billion in terms of total assets along with approximately $8.5 billion in terms of total liabilities, which, for a company that manufactures, sells and distributes so much physical equipment across the globe, is a more than solid balance sheet breakdown, with much more in the amount of things owned versus things owed, which tends to always be a good thing for any company of any industry, offering itself more options than a handful, I believe.

Onto the company’s income statement, Wabtec’s recent annual revenue figures (specifically measuring during and between 2019 and 2023) have been, especially in the context of its previously stated price-to-earnings ratio, not terribly impressive or growthy, for lack of a better term, as the company’s have indeed technically grown from its reported numbers on 2019 and 2023, but, in between there were certainly some years that weren’t, let’s say, all that stupendous, as the growth was muted (particularly during 2020 and 2021, which makes a good deal of sense given the public health crisis and fiasco that was COVID-19, but it sadly takes a slight amount of credibility out of my initial assumption regarding Wabtec being more recession resistant than I thought), ranging between a relative low of just north of $7.5 billion (2020) and its latest reported figure being a relative high of nearly $9.7 billion, as reported during year end of 2023.

Growth? Sure.

Enough growth to justify paying this much of a premium for an ownership stake in the company given all of the facts and trends we know right now? I don’t think so.

At any rate, all hope is never completely lost, so let’s walk over to the company’s cash flow statement and gain some more perspective in this realm.

According to the company’s cash flow statement, Wabtec’s total cash from operations (also measured during and between 2019 and 2023) have been very consistent, which is great to see, basically hanging out each and every year at a little over $1 billion, one year being an exception, 2020, which dribbled down to $784 million, but this makes complete sense given the state of affairs at the time and frankly isn’t as bad as it could’ve been, by any means.

Wabtec’s stock fundamentals

In gaining some initial insight into the company’s margins, let’s dig a little deeper into the company in this respect, as according to Charles Schwab’s platform, Wabtec’s net profit margin is propped up at 9.31%, which, as it measures up against the profit margins of its competitors, is somewhere within the informal middle, as, for example, another mass manufacturer by the name of Dover Corporation maintains a net profit margin of 17.28%, yet another competitor of these companies is Cummins, reportedly holding a net profit margin of 6.06%, which makes enough sense given just how expansive Wabtec’s operations are, how much inventory they have on hand at any given time that may or may not bite into its margins, not to mention the fact that a business such as this can be subject to fluctuating commodity costs, steel being one of many examples of a metal this company works a lot with and more than likely has to hedge against in order to buy its raw goods at a lower, more attractive price.

At the end of the day, Wabtec’s net profit margin being wedged between two of its largest and fiercest competitors is hardly a concern for me, as having a nearly low double-digit net profit margin in this industry is hardly anything to scoff at or disregard.

Should you buy Wabtec stock?

Some companies aren’t all that important in the grand scope of societal wants and needs, and on the other hand, some companies are like Wabtec.

Without this company and its products, the railroad would be instantly less safe and the transport of goods across the nation would become far less efficient, and more importantly, those that work diligently in transporting said goods day in and day out wouldn’t be as well protected from the naturally dangerous positions and duties they fulfill.

But this isn’t ultimately about how “good” or “important” of a company Wabtec is, but more so in the context of this platform (train humor) this is about whether or not, given the aforementioned facts and figures, Wabtec’s stock (NYSE: WAB) can be considered a good stock to ponder an investment in or not, or maybe somewhere in the middle.

On this note, sure, Wabtec maintains a great overall balance sheet posture, it serves a diverse range of industry leading clients that it likely will not part with anytime soon, its revenues have been generally stable-to-growing on a recent year-over-year base, its cash flows have been consistent and its net profit margin is somewhat competitive on a comparable basis, but the real sticking point is in the stock’s present price-to-earnings ratio, as it implies that Wabtec’s shares are trading at a notable premium, and while paying a premium for an ownership stake in a company can be justified primarily through revenue growth and/or defined future growth catalysts, it simply is not growing at a quick enough rate nor do I see many specific catalysts that would reasonably warrant and ultimately justify paying this much for the company’s stock at the moment.

Until Wabtec’s shares trade down to more reasonable, fair value levels, I feel as though I have hardly any choice but to stick this company’s stock with a “sell” rating for the time being.

DISCLAIMER: This analysis of the aforementioned stock security is in no way to be construed, understood, or seen as formal, professional, or any other form of investment advice. We are simply expressing our opinions regarding a publicly traded entity.

© 2024 MacroHint.com. All rights reserved.